Australian Super Death Insurance Cover

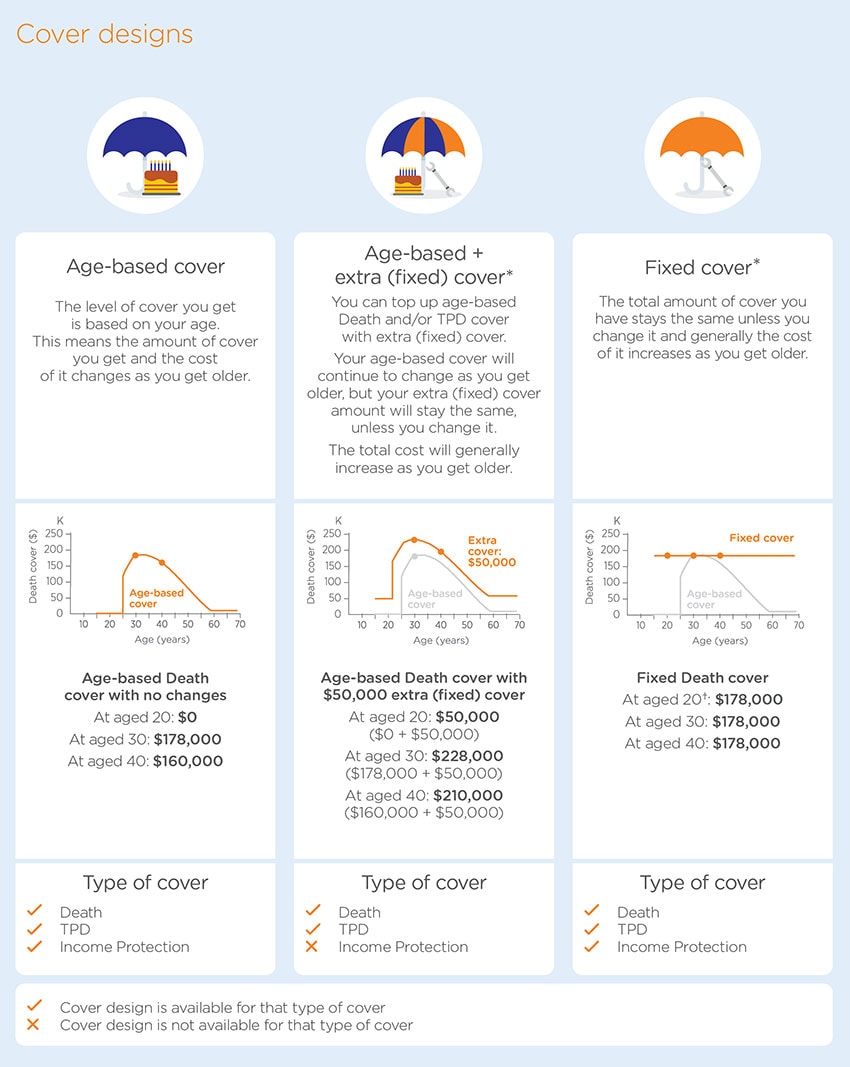

You can apply for age-based age based extra fixed or fixed cover. Taking out death cover through super is a great way to live with peace of mind without having to add insurance premiums to the list of household expenses.

Super Insurance Insurance Through Super Australiansuper

Life cover is also known as life insurance or death cover.

Australian super death insurance cover. Like your death and TPD cover upon joining Australian Super youll receive a basic age-based income protection policy which automatically starts when you turn 25. Select Insurance in your super guide. Application to increase Income Protection cover after a salary increase.

Life insurance australian super. Eligible members receive age-based Death Total Permanent Disablement TPD and Income Protection cover. Please put an X next to each type of cover that you want to cancel.

Application for Life Event insurance cover. Up to 15 million cover depending on your age 1. You can apply for life insurance cover with AustralianSuper up to the value of 15 million without the need for a medical test and you can change your cover amount at any time.

Application to change Income Protection work rating. Life cover in super is typically only for relatively small amounts though you can opt to increase your cover with financial research firm Rice Warner stating in its Underinsurance in Australia 2020 report that the median default life insurance cover within super meets approximately 65 to 70 of the basic cover needs of average households but a much lower proportion for parents with dependent children. Superannuation death cover also known as life cover is a type of life insurance cover.

This pays a lump sum or income stream to your. Before you change your cover you should read our Insurance in your super guide. AustralianSuper provides most members with basic insurance cover with their super account.

It pays a specified amount of money or benefit when you die. Death cover can give your loved ones financial security when youre no longer around to provide for them. Age-based cover is designed to provide a minimum amount of cover for changing needs as you get older.

The death cover is issued by our insurance partner TAL to AustralianSuper Pty Ltd through an ordinary group insurance policy GR1000-GL which is outside of super. At the time of death. Many superannuation plans include insurance as part of their offer.

Types of life insurance in super. This cover provides a basic level of protection if you die or become ill or injured. Youll find details about your insurance options including cover designs work ratings changing or cancelling your cover standard exclusions and information about nominating your beneficiaries.

This arrangement is facilitated by TAL and is enabled as a result of our long term partnership. Term life insurance is what we usually mean when we talk about life insurance. There are very strict guidelines and laws that AustralianSuper has to follow when paying out a super account following the death of a member.

15000 funeral advancement included within the cover 7. Super funds typically offer three types of life insurance for their members. Death cover Death cover can help ease financial stress by paying a lump sum to your beneficiaries if you die.

There is no limit on the amount of Death cover you can have see page 25 for details. Superlifes australian super transfer service. Our insurance options are flexible and you can change or cancel your cover as your life changes.

It contains terms and conditions about insurance including costs your eligibility for cover how much you can apply for when cover starts and stops and limitations or exclusions. If you make a binding nomination your super fund will pay your account balance to whoever youve nominated as long as your nomination is valid and in. Insurance in your super guide Included in this guide youll find the following forms.

The money goes to whoever you have nominated as beneficiaries on the policy. Cost of Death and TPD cover Industry Division members are provided when they join Age Type of cover Number of units Cost per unit Cost of cover Weekly cost for Death and TPD cover 1519 Death TPD 1 0 0751 na 075 na 075 2024 Death TPD 1 1 0751 0948 075 095 170 2534 Death TPD 3 1 0751 0948 225 095 320 3549 Death 4 1 0751 0948 300 095. Is available from age 15 up to age 70.

If you die Death cover may provide a lump sum payment before tax to your beneficiaries or estate. You may need Total Permanent Disablement TPD cover. Most super funds offer life total and permanent disability tpd and income protection insurance for their members.

However you can opt to take a fixed cover income protection policy instead where unlike the aged-based cover your benefit does not reduce as you get older but the premium will generally rise. With unitised cover how much you are insured for is based on multiple units of cover. You can find out more about Death cover through AustralianSuper by reading our Insurance in your super guide.

It is a way of protecting your familys financial future. It can provide a lump sum payment to your beneficiary if you die or are diagnosed with a terminal illness to provide for your dependants when you are no longer around. Covers diagnosis of Terminal Illness where death is likely to occur within 24 months 10.

Life cover also called death cover. If the deceased member didnt have insurance cover with AustralianSuper the amount payable will be made up of the members account balance only. Who can apply for a death payment.

You have the same duty before you extend vary or reinstate your insurance cover. Death insurance can provide financial security for your family. Someone who will receive a benefit or asset in the event of the owners death.

Death insurance cover also called life insurance will pay out a sum of money for example 500000 so that your loved ones can take care of ongoing expenses - like a mortgage for instance. 3 Verve Super Insurance Guide Contents Death and Total and Permanent Disablement Cover. If you dont nominate anyone a trustee or your estate will decide where the money goes.

If you put an X next to any of the cover types below you will no longer be insured for that cover and you or your beneficiaries will not be able to make an insurance claim for that type of cover. Insure up to 2 people on the same policy. Complete this section if you want to cancel part or all of your cover.

Insurance cover available through the Fund is issued to members through life insurance policies issued by AIA Australia Limited ABN 79 004 837 861 AFSL 230043. A binding nomination instructs your super fund who you want your super to be paid to in the event of your death. If you join online you can choose to receive unitised death cover if eligible.

You may automatically receive unitised death cover when you join QSuper through an employer depending on your age account balance and eligibility.

Change Or Cancel Your Cover Australiansuper

Super Insurance Insurance Through Super Australiansuper

Life Insurance In Superannuation Australiansuper

Interesting Facts About Life Insurance In Australia Shared By Brian Bergstrom Insurance Age Life Insurance Facts Life Insurance Quotes Life Insurance Companies

What Does Pet Insurance Cover Pet Insurance Pet Insurance Dogs Pet Insurance Best Pet Insurance Dogs Puppys Pet Pet Insurance Pet Health Care Pet Health

The State Of Life Insurance In Australia An Infographic Via Sillymummy Com Life Insurance Quotes Mortgage Marketing Life Insurance

What Is Superannuation Insurance Types How To Claim Owen Hodge Lawyers

![]()

Insurance Claims Statistics Australia 2020 Does Your Insurer Pay Claims

20 Disadvantages Of Life Insurance Through Super Insurance Watch

Life Insurance In Superannuation Australiansuper

Super Insurance Insurance Through Super Australiansuper

Is Travel Insurance Necessary When Travelling Abroad Galaxy Images Milky Way Milky Way Galaxy

The Penn Mutual Life Insurance Company Announces Sponsorship Support For Two Olympic Rugby Life Insurance Companies Whole Life Insurance Life Insurance Premium

20 Disadvantages Of Life Insurance Through Super Insurance Watch

Resultado De Mercedes Significado Del Nombre Al Reves Significados De Los Nombres Mercedes Nombre

Super Insurance Insurance Through Super Australiansuper

Ashton Has 2 Days Left To Live Mixed Breed Adoption Dog Adoption

Posting Komentar untuk "Australian Super Death Insurance Cover"