Health Coverage Transparency Rules

No Surprises Act health plan transparency requirements of the Consolidated Appropriations Act 2021 CAA and the Health Coverage Transparency Final Rule Multiemployer Plan Considerations General Considerations The NCCMP supports the objectives of the No Surprises Act to protect plan participants from surprise medical bills. More details on transparency rules that apply in 2022 and beyond.

Health Insurance Powerpoint Slides

Just before Halloween the Departments of Treasury Labor and Health and Human Services the Departments released their final rule on health plan price transparency.

Health coverage transparency rules. 2 The term grandfathered is defined in section 1251e of the Affordable Care Act and is used by the IRS DOL Centers for Medicare Medicaid Services and HHS to refer to certain group health plans and health insurance coverage existing as of March 23 2010 the enactment date of the. Within two days the US. The rules also include proposals to require plans and insurers to disclose in-network provider negotiated rates and historical out-of-network allowed amounts through an internet website thereby allowing the public to have access to health insurance coverage information that can be used to understand healthcare pricing and potentially dampen the rise in healthcare spending.

Both the final regulation on Transparency in Coverage TiC rule issued October 29 2020 and the transparency requirements provisions for plans and issuers within the Consolidated Appropriations Act of 2021 CAA require notice and disclosure of health plan costs beginning either December 27 2021 or January 1 2022. Within the last year Congress and the Departments of Treasury Labor and Health and Human Services the Departments have issued a bevy of new rules for group health plans that aim to encourage transparency in health care costs and compliance. The rule does not apply to Medicare Medicaid grandfathered health plans standalone vision or dental plans short-term limited duration plans HRAs FSAs or HSAs.

On November 15th the Department of Health and Human Services the Department of Labor and the Department of the Treasury collectively the Departments released the Transparency in Coverage proposed rules outlining a new set of healthcare pricing transparency requirements targeted at giving patients access to pricing information directly through their health plans. On December 6 2020 we posted an article titled RADICAL new transparency rules likely apply to your health plan in one year. In October 2020 the Departments released final rules on the transparency in coverage requirements that apply to group health plans they.

Chamber of Commerce and the Pharmaceutical Care. The requirements phase in over three years with the first compliance requirements becoming effective January 1 2022 and they present a dramatic expansion of price transparency for health. In addition to the Transparency in Coverage Rule health plans will need to comply with the No Surprises Act which also goes into effect next January.

Current Status of Final Rule 4 If Supreme Court Decision Texas v. As part of this project CMS has also added a shared-savings provision to the medical loss ratio MLR rules. In simple terms it means employer-sponsored group health plans and health insurance issuers in the individual and group markets are going to be required to make cost-sharing information available upon request to members.

On January 1 2022 parts of the new federal transparency rules Transparency in Coverage and the No Surprises Act will go into effect mandating employer plan sponsors and health plans to. 1 See Departments finalize transparency in health coverage rule Insider November 2020. 1 This final rule is a historic step toward putting health care price.

The forthcoming laws complement the Hospital Price Transparency Rule in making it easier for patients to compare care costs avoid surprise bills and know the price of care in advance. On October 29 2020 HHS and the Departments of Labor and Treasury finalized a Transparency in Coverage Final Rule requiring most health plans and issuers in the individual and group commercial markets to disclose cost-sharing estimates and additional content to enrollees upon request and to publicly post negotiated in-network provider rates historical out-of-network allowed amounts and. In October 2020 CMS released the TiC Final Rules which require group health plans and health insurance carriers carriers to publicly post standard charge information and negotiated rates for common shoppable items and services in an easy-to-understand consumer-friendly and machine-readable format.

While the Transparency in Coverage Rule applies directly to group health plans an issuer or third-party administrator TPA may support the compliance requirements for the group health plan. Hot off the Press. On Friday 820 the Department of Labor issued an update around the timeframe and enforcement of both Transparency in Coverage and the No Surprises Act for payer price transparency.

Two New Lawsuits Challenge Insurer Transparency Rule. Final transparency-in-coverage rules require group health plans and insurance issuers in the individual and group markets to disclose extensive price and cost-sharing information beginning in 2022. California renders ACA unconstitutional transparency rule will become ineffective expected decision in 2021 session Potential future litigation challenges.

This rule which was included in last Decembers omnibus spending bill is aimed at protecting patients from unexpected out-of-network bills. Health Coverage Transparency Rules. Doesnt the rule violate HIPAA or other security or privacy rules.

This rule entitled Transparency in Coverage requires group health insurance carriers and self-insured plans to disclose rates and cost-sharing information for all covered items and services. The Transparency in Coverage final rule released today by the Department of Health and Human Services HHS the Department of Labor and the Department of the Treasury the Departments delivers on President Trumps executive order on Improving Price and Quality Transparency in American Healthcare to Put Patients First. HUBs EB Compliance Team.

Transparency in Coverage Final Rules. In case you havent heard the IRS Department of Labor and Department of Health and Human Services have issued the Transparency in Coverage ruleBut what exactly is it.

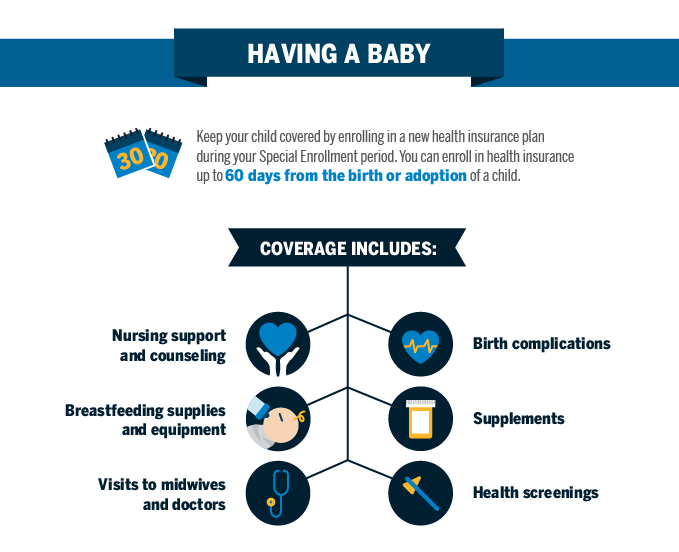

Qualifying Event Baby Blue Cross And Blue Shield Of Texas

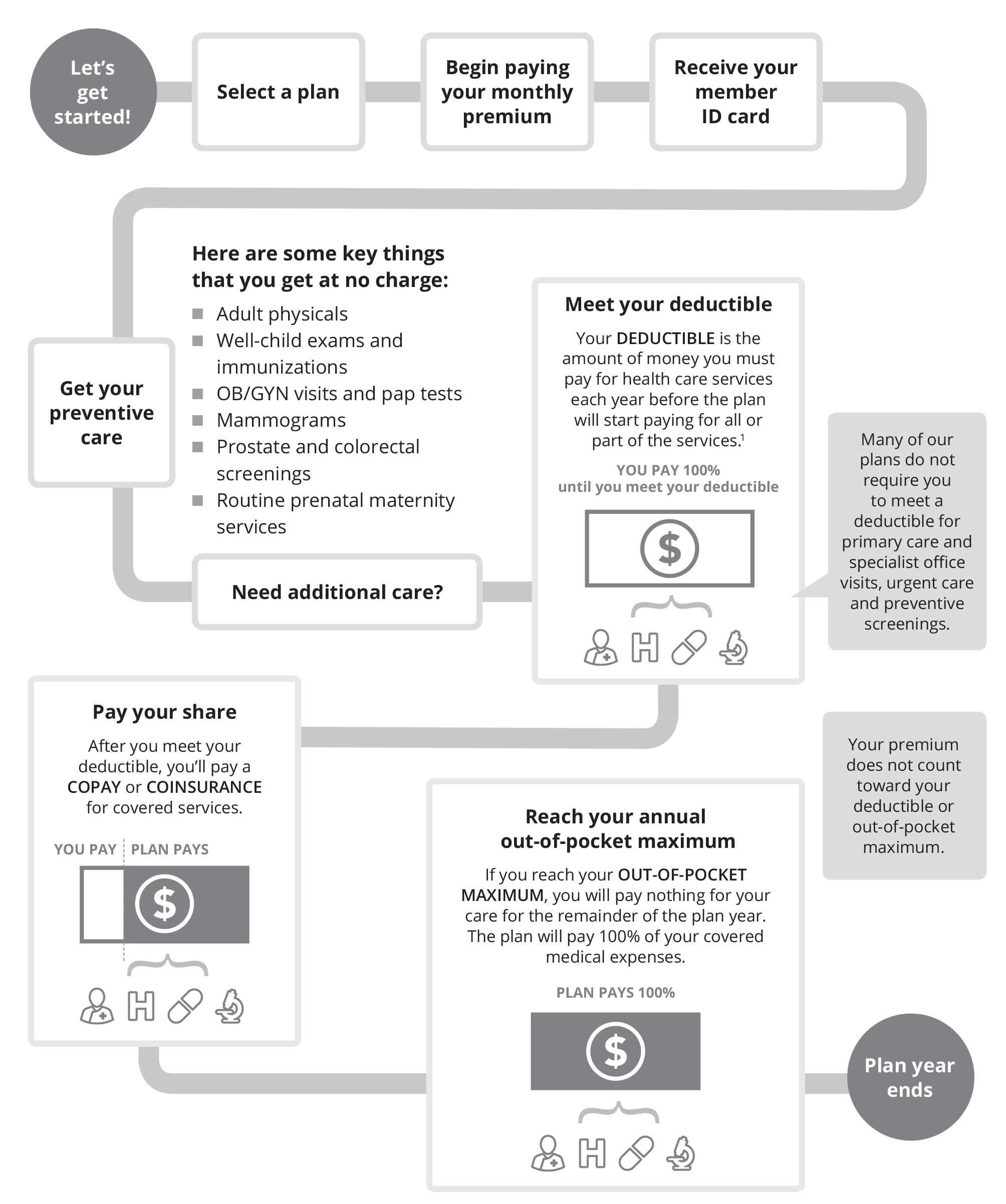

Cost Sharing Health Insurance 101 Blue Cross Nc

Paying Insurance Bills Health Insurance 101 Blue Cross Nc

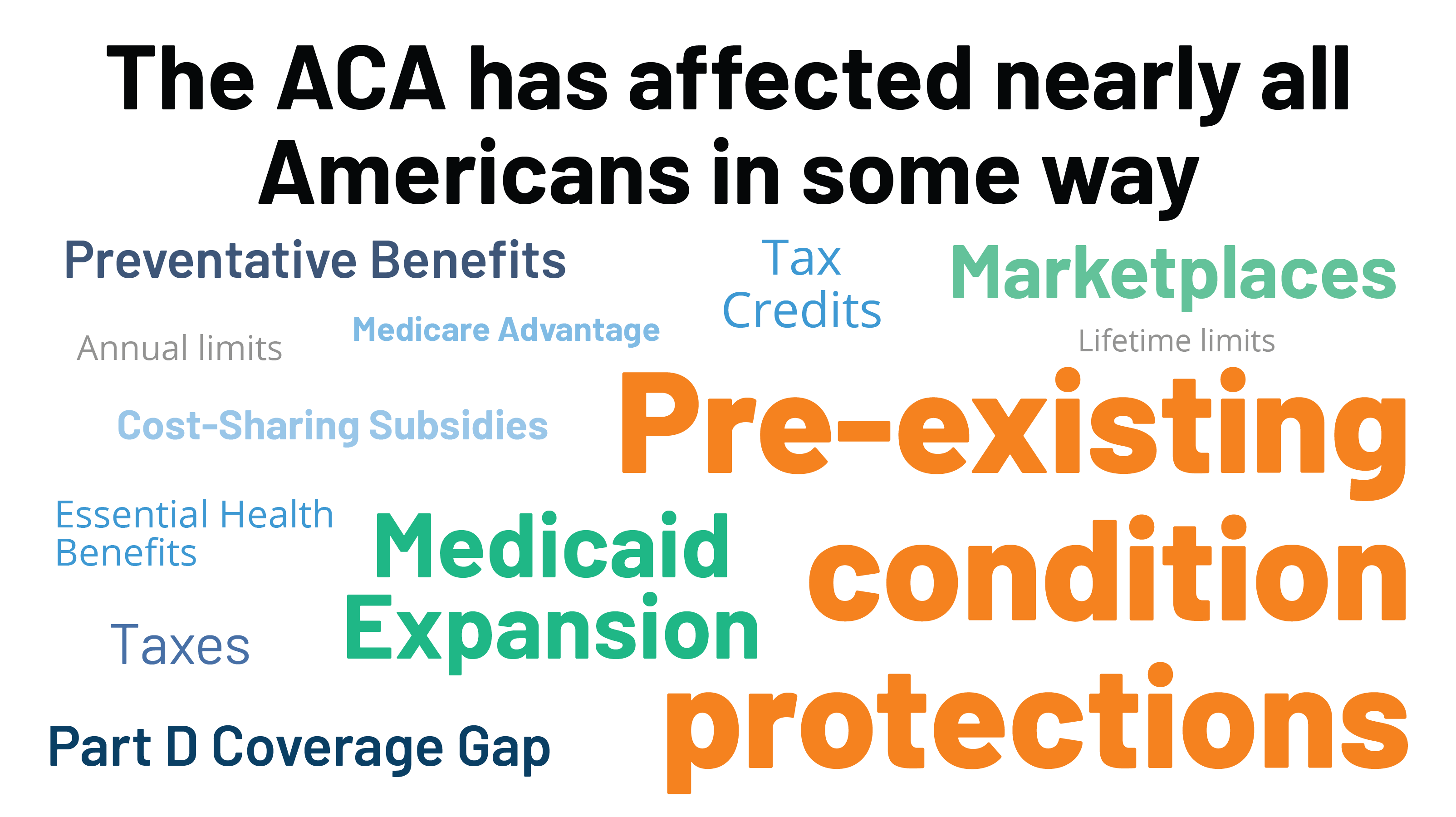

Potential Impact Of California V Texas Decision On Key Provisions Of The Affordable Care Act Kff

Will Health Consumers Morph Into Health Citizens Healthconsuming Explains Part 5 Health Care Policy Health Care Coverage American Medical Association

Health Insurance Costs Carefirst Bluecross Blueshield

Drone Infographics Buy Or Renew Car Insurance Policies Online Buy Car Insurance Policy In Easy Ste Car Insurance Renew Car Insurance Car Insurance Online

Barriers To Price And Quality Transparency In Health Care Markets Rand

Functions Of Irda Compare Insurance Commercial Vehicle Insurance Business Insurance

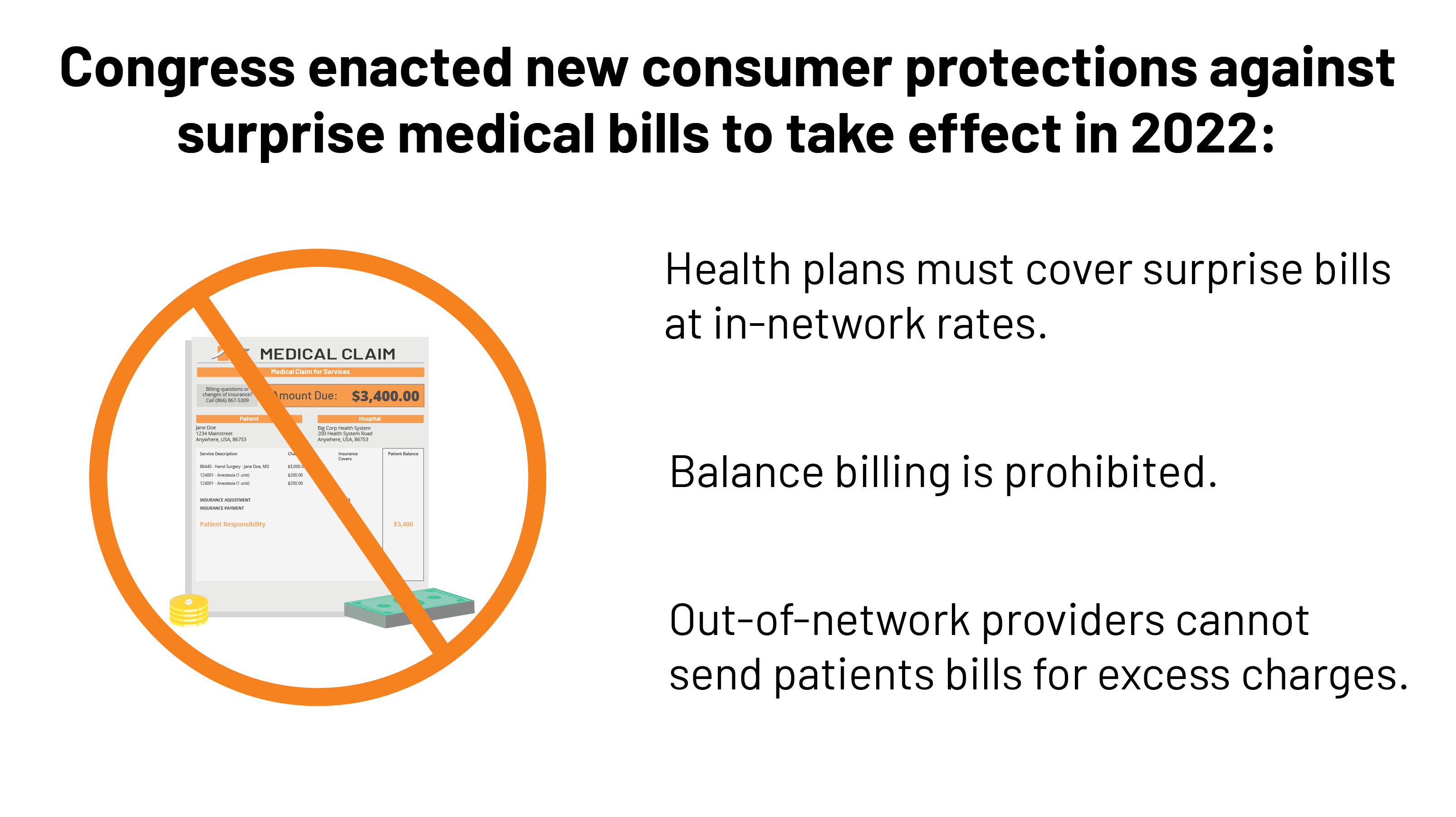

Surprise Medical Bills New Protections For Consumers Take Effect In 2022 Kff

President Trump S Record On Health Care Kff

The Future Of U S Health Care Replace Or Revise The Affordable Care Act Rand

Cost Sharing Health Insurance 101 Blue Cross Nc

The Future Of U S Health Care Replace Or Revise The Affordable Care Act Rand

Data Management Vs Data Governance Data Science Learning Strategy Infographic Data Science

Posting Komentar untuk "Health Coverage Transparency Rules"