Does Comprehensive Insurance Cover Breakdown Admiral

You can purchase a membership to Uconnect Services for a price of 1499 per month. Can I get breakdown cover.

Third Party Fire And Theft Car Insurance Moneysupermarket

Comprehensive coverage pays to repair or replace a covered vehicle thats stolen or damaged by something other than collision or rolling over.

Does comprehensive insurance cover breakdown admiral. Pay and claim - This offers a cheap way to cover your car. Admiral MultiCar insurance allows you to insure several cars. Home emergency cover is a type of insurance that covers the cost of calling out a tradesman due to a sudden incident such as your boiler breaking down or your pipes bursting.

This means that if you have an accident you can claim to have your car fixed and your insurance provider may also compensate anyone else involved if eligible. If you need European assistance call us on 0044 02920 943 111 and well send help to you within the territorial limits of Europe. It might even cover you for accommodation and car hire.

Admiral offers the following types of insurance. Before you choose make a list of what you expect from your insurance. Manufacturers - When you buy a new car the manufacturer might include free breakdown cover for a year or so.

Youll be fully covered under the same terms as your current car insurance policy which includes any listed named drivers. European Breakdown Cover. Assistance after an accident isnt a feature of our breakdown cover.

How much does Uconnect cost per month. When getting a temporary insurance quote as normal youll be presented with the option to add breakdown cover or one of our other additional extras like excess reduction to your policy. Houston Attorney Eric Dick Law Firm Property Damage Home Insurance Claim Specialist Hailstorm Wind Roof Allstate State Farm USAA Liberty Mutual Lawyer Multis.

Can I use Admiral Breakdown Cover to move my car if I have an accident. For more extensive repairs including damage caused by your home emergency youll have to claim on your home insurance২৫ জন ২০২১. Includes all the same benefits as our National Cover but with added European assistance.

Choose from three types of cover with Admiral. Although comprehensive car insurance offers the highest level of cover there are still exemptions. If you have an older car and regularly drive on the motorway or drive long distances then breakdown cover will be a priority for example.

Banks - You might find you have breakdown cover as a perk with your bank account. Aside from additional cover for breakdowns a courtesy car and legal expenses that may or may not be included with a standard policy there are also some common exclusions to watch out for. Bear in mind that every comprehensive policy is different including Admiral Car Insurance and each one comes with its own benefits.

If you meet our eligibility criteria for temporary insurance you can add breakdown cover to our standard car van and motorbike policies from 1 hour to 28 days in duration. If youd like us to repair your car if you bumped it parking then you may want to pick comprehensive cover rather than third party fire and theft. It provides a greater level of cover than the 2 other options available third party only and third party fire and theft and it allows you to make a claim for an accident even if it was your fault.

Comprehensive coverage also covers glass claims and windshield repair. Home start Youll be covered if your car wont start at home. Admiral MultiCover is designed to cover your car van and home insurance on one discounted policyYou can start with just one vehicle or home and any others.

Its important to understand that if such a clause isnt included you arent covered to drive other cars even if your insurance policy is fully comprehensive. National recovery As well as roadside repair you can be towed to a UK location. In short your car insurance does not cover you for breakdown repairs.

Third Party Fire and Theft. Well cover the callout fees and mileage charges needed to repair or assist with your car. Comprehensive car insurance explained.

Comprehensive car insurance also known as fully comprehensive is the top level of non-business insurance you can get for your car. It only covers you for things like injury or damage resulting from an accident to another car or publicprivate property fire theft and vandalism. If you have comprehensive insurance this will be covered when you make a claim.

Caravan and trailer cover. Comprehensive cover will cover all these eventualities. The best part is it will be at no additional cost to you.

Onward journey Includes transport to get you home if your car breaks down. Which level of car insurance should I buy. Click Here For Our Full ReportComprehensive insurance is widely known as coverage that assists in paying to replace or repair your vehicle if your car was to.

Single car van multicover multi-car learner driver car sharing classic car black box electric car and breakdown cover. Whats covered depends on the policy itself. Some car insurance companies include roadside assistance otherwise known as breakdown cover in their comprehensive insurance cover plans that could get you out of a difficult situation while you are on the road.

Comprehensive car insurance - also known as fully comprehensive - covers damage to yourself your car as well as compensating a third party if you are involved in an accident. Do I need to arrange short term car insurance to cover the car. If you have an accident and your car needs to be moved our Claims team will help you arrange this.

Insurance - Some insurance companies include breakdown cover in their policies. For example damage caused by fire wind hail flood theft vandalism falling objects and hitting an animal is covered. It is fully comprehensive cover and includes as standard.

If you do drive another car without being insured youre breaking the law and you risk a hefty. Fully comprehensive car insurance is the highest level of cover you can buy to protect your car. Included in Admiral car insurance comprehensive cover as standard may not be included in third party or third party fire and theft Admiral also offers breakdown cover that includes.

Admiral will pay to recover caravan and trailers up to 8ft 3in wide and 35t in weight. This is Jason Bentley with the Jason Bentl. No the good news is you wont be responsible for arranging any extra car insurance.

With such a vast range of types of insurance available Admiral is a suitable candidate for many consumers. This provides cover above and beyond that provided by third-party fire.

Motor Insurance In Uae Insurance Broker Insurance Companies In Dubai

The Best Cheap Car Insurance For 2021 Money

Top 10 Car Insurance Companies In Uk Types Of Car Insurance Business

Motor Insurance Will Car Insurance Cover Engine Failure Car Co Uk Faqs

Temp Cover Temp Car Insurance Insure Daily

How Long Does A Car Insurance Claim Take To Settle

Comprehensive Car Insurance Explained Rac Drive

Top 10 Car Insurance Companies In Uk Types Of Car Insurance Business

Car Insurance Traps To Avoid Confused Com

European Car Insurance Cover Moneysupermarket

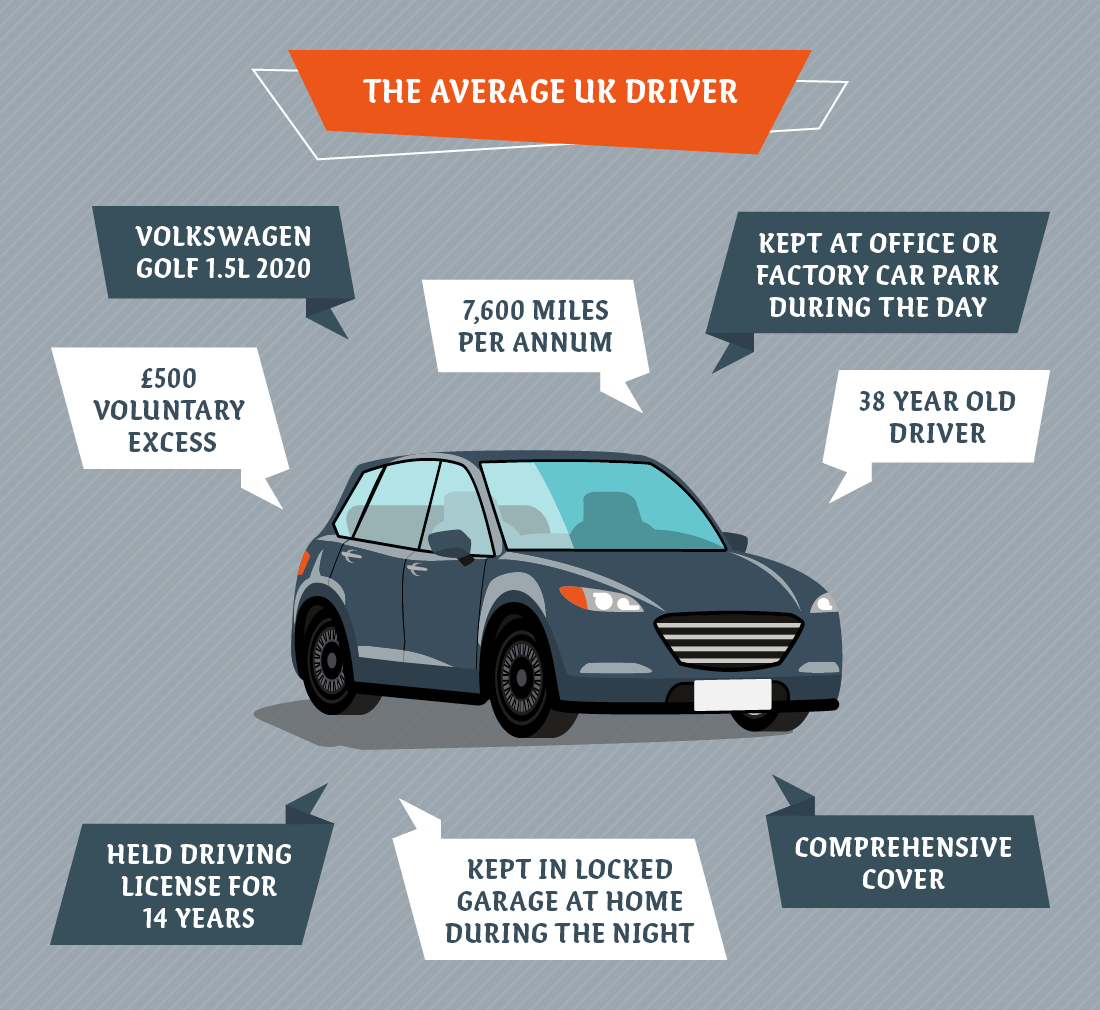

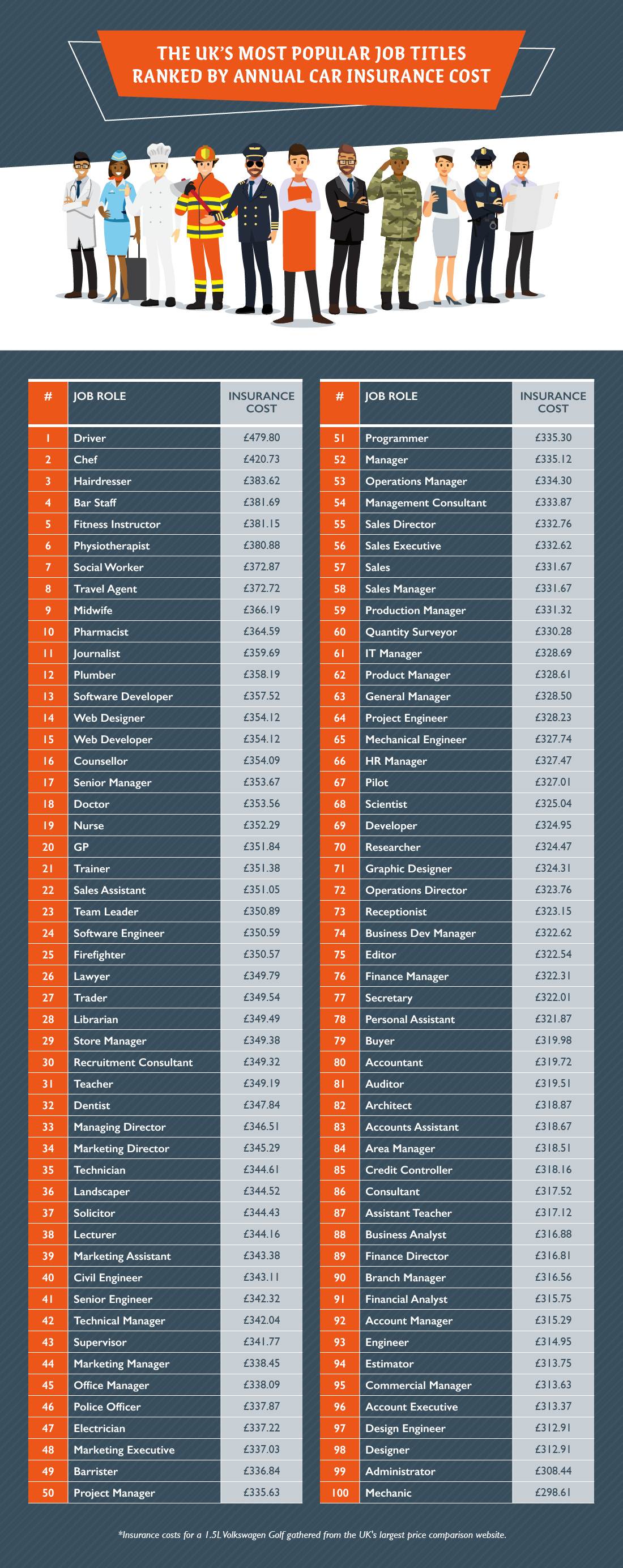

How Much Does Your Job Title Impact Your Car Insurance Costs Vanarama

Get To Know No Claims Discounts Axa Uk

Best Comprehensive Insurance Companies Of 2021

How Much Does Your Job Title Impact Your Car Insurance Costs Vanarama

Types Of Car Insurance Coverages Types Of Insurance Coverage For Cars Types Of Insurance Coverage For Auto Types Of Auto Insurance Coverages What Type Of Vehicl

No Claims Bonus How It Gives You A Discount Admiral

Selection Of The Best Car Insurance Insurance Selection Car Insurance Car Insurance Tips Best Car Insurance

What Is Temporary Car Insurance Veygo By Admiral

Posting Komentar untuk "Does Comprehensive Insurance Cover Breakdown Admiral"