Does Commercial Insurance Cover Riots

Building owners are responsible for insuring their real estate. Businesses that are forced to limit hours or suspend operations due to rioting vandalism or civil commotion and have coverage for this particular loss of income may be covered after an initial waiting period.

Can I Run Over Rioters If They Are Attacking My Vehicle Is It Legal

Your insurance provider will be able to explain what is included.

Does commercial insurance cover riots. Civil authority insurance covers income lost during a limited period of time. Are businesses covered for property damage from riots. Stewart estimated damage and theft of merchandise could reach 45000 but was left wondering whether his insurance carrier would cover the losses and if so how much would be covered.

Under modern all risk insurance policies all risks of loss except those which are specifically excluded are covered under the policy. In addition to riots civil commotion vandalism and fire any property damage caused by things that are being set on fire such as a police car or a flipped vehicle typically are covered as well. In fact commercial property insurance covers damage due to vandalism and civil disorder.

In general unless specifically excluded a business owners insurance policy will cover all physical damage to property and the contents inside even when the cause is riots civil. Vandalism and fire are covered under virtually all businessowners and commercial insurance property policies. These policies also cover looting that occurs in the context of riots or civil commotions.

Glass Coverage-- Many commercial policies cover glass. For a residential property if you have an HO-3 policy commonly referred to as all-risk or open perils then the policy will cover something along the lines of direct physical loss to your property. Commercial property insurance covers you if your property is looted.

For businesses who have purchased property coverage their commercial property insurance policy will cover losses from protests riots and civil disturbances. Many commercial property policies include a section on naming perils. Business property that has been damaged by riot civil commotion.

Most insurance providers cover the damages caused due to a riot but under their comprehensive vehicle insurance policies as per their policy wordings. The OD cover protects your bike against damages that includes natural calamities earthquakes man-made calamities riots vandalism strikes fire accident vehicle theft or damage beyond repair. Fortunately for them all of the Insurance Services Offices causes of loss forms for commercial property insurance cover losses caused directly or indirectly by riot and civil commotion including looting that occurs at the time and place of a riot.

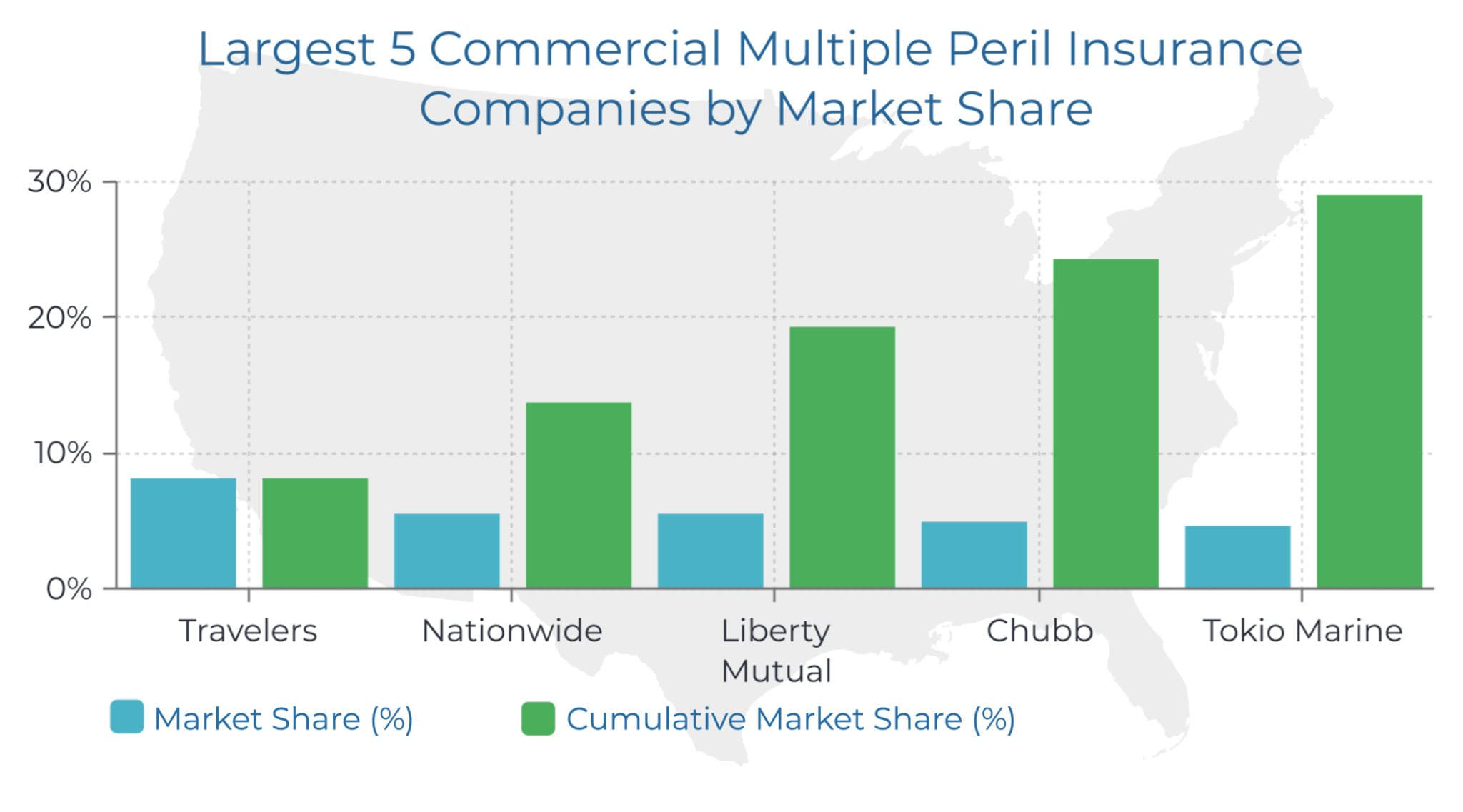

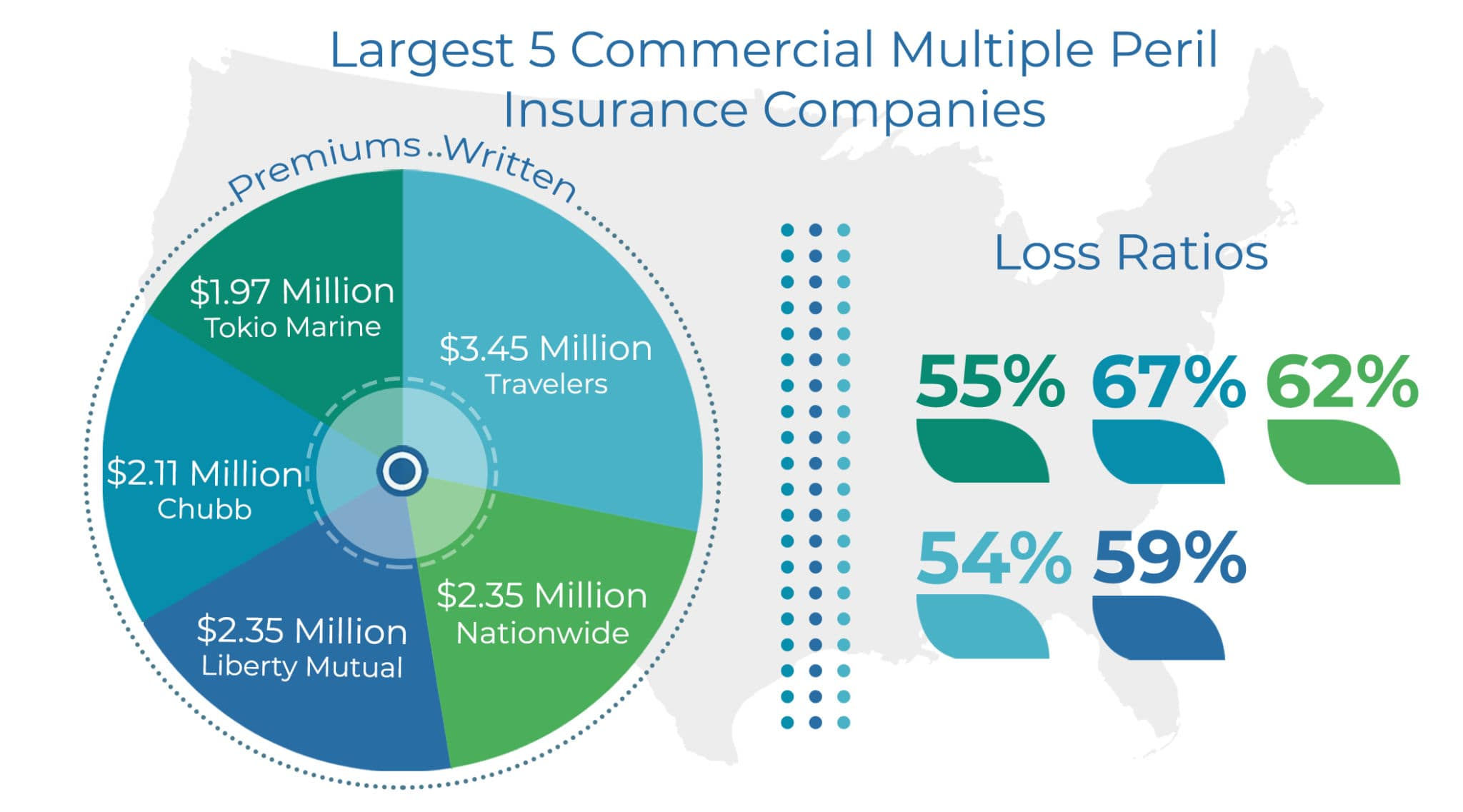

Mak published a report called Does Business Insurance Cover Riots Looting. Commercial insurance covers riot damage in most cases through commercial multiple peril insurance policies. Insurance companies write over 42 million premiums per year in multiple peril commercial insurance and riot coverage policies.

Your physical structure whether it be a commercial property Building or residential property Dwelling is almost always covered under your insurance policy. Standard commercial policies typically include coverage for physical loss or damage to the insured premises and other business property resulting from looting vandalism and riots. Riot damage claims are paid under the optional Comprehensive Insurance plan since it covers damages to your bike under the Own Damage OD cover.

However you may need a separate floater to replace plate glass windows so thats something to consider when you look at your business policy. Whether a specific loss will be covered depends on the actual language in the applicable policy and any coverage exclusions that may apply. Commercial property insurance covers damage that results from vandalism rioting and civil commotion.

Business insurance covers acts of vandalism riots and civil commotion. Generally speaking insurance will cover not only property damage but also any harm to the contents inside of the property when the cause is civil unrest riots or anything similar. Many policies will cover a loss of income while your shop is under repair.

Riot and civil commotion insurance is a policy that covers financial loss for damage to a property caused by violence inflicted by a group of people or a mob. Riot and civil commotion are perils that can be found listed in a property insurance. Such policies typically have a 72-hour deductible so it wont pay for the first 72 hours and they have maximum coverage period of four weeks.

Does an Insurance Company Cover Commercial Vehicles Damages Due to Riots. What Does Riot and Civil Commotion Insurance Mean. The answer to this question is yes but only the comprehensive commercial vehicle insurance policy not the third party.

Commercial property insurance. Riots and Civil commotion are not excluded and indeed they usually are specifically named perils under most commercial policies. Your policy may also cover loss of income if it results from physical damage to the premises that have prevented the business from re-opening right away.

Commercial Insurance Riot Damage Best Providers

Commercial Insurance Riot Damage Best Providers

Struggling Small Businesses Confronted With Looting Insurance Questions Fox Business

Will Your Insurance Cover Riot Damage Citypress

Viewpoint A Primer On Insurance Coverage For Civil Unrest

Commercial Insurance Riot Damage Best Providers

Commercial Insurance Riot Damage Best Providers

Commercial Insurance Riot Damage Best Providers

Commercial Insurance Riot Damage Best Providers

Protest Riot And Demonstration Insurance Insurancequotes

South Africa Last Riots Damage Worth 1 7 Billion Says State Insurance Company Africanews

Struggling Small Businesses Confronted With Looting Insurance Questions Fox Business

Riots Following George Floyd S Death Could Cost Up To 2b

A Record Year For Civil Unrest In The United States Visualize Verisk Analytics

South Africa Most Looted Shops Still Shut Africa Dw 02 08 2021

This Is The Insurance Bill For Damage And Looting During Protests Over George Floyd S Death And That S Just In Minnesota Marketwatch

Insurance Industry Takes Stock Of Looting Fallout

Insurance Payout Of 2020 Riots Most Costly In History Could Top 2 Billion Report Washington Times

Commercial Insurance Riot Damage Best Providers

Posting Komentar untuk "Does Commercial Insurance Cover Riots"