Minimum Insurance Coverage California

Minimum Car Insurance Coverage California Aug 2021. 15000 bodily injury per person.

The 2020 Changes To California Health Insurance Ehealth

Minimum Bodily Injury Liability Limits.

Minimum insurance coverage california. Property damage liability coverage. In order to comply with California State Financial Responsibility Laws the following minimum auto insurance coverages apply. The minimum auto insurance requirements in California are 15305 in liability coverage.

If you purchase full coverage instead the average cost increases to 1804 per year or 150 per month. Auto Life Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. Currently employers in California need to purchase a workers compensation policy with these minimums for employer liability.

What is considered full coverage in California. You must have this much coverage. Here are the minimum liability insurance requirements per California Insurance Code 115801b.

Californias full coverage auto insurance usually includes liability insurance comprehensive insurance and collision insurance. Ad 4 out of 5 New Customers Recommend Progressive. California requires drivers to carry at least the following auto insurance coverages.

While every state has some sort of mandatory guideline regarding car and auto insurance coverage the minimum limits vary by state. The limitations when you are financing a vehicle are the same as the state minimum which is as follows. Under California law you are required to have two types of liability coverage with minimum coverage limits.

The following is a breakdown of minimum liability requirements for California. Get Instant Quality Info at iZito Now. Ad Were Here to Help.

Easily Shop Policies Available to You. Property Damage Liability Coverage - The minimum limit for Property Damage coverage is 5000 per accident. Yes What are the minimum limits for California.

The Minimum Coverage plan usually wins on premium cost and since the first 3 primary care visits a year are free it gives better benefits than the Bronze 60. Coverage C is normally 50 of coverage A or is subject to an established amount agreed upon by. Bodily Injury Liability Coverage - The minimum limits for Bodily Injury coverage are 15000 per person and 30000 per accident.

Ad Get Minimum Insurance. Compare Multiple Rates Side By Side On The 1 Website for Ease of Use. Switch Start Saving Today.

Liability insurance compensates a person other than the policy holder for personal injury or property damage. 100000 per occurrence 100000 per employee. Options are Available - Dont Wait.

Plans From 1Day - Call Now and Speak to a Live Agent. 15000 for injurydeath to one person. Ad 3000 stores listed Find your best store brand Verified Coupons Promo codes updated daily.

Ad Get Started Now by Choosing the Right Coverage Using our Car Insurance Calculator. However these are just averages. Latest money saving best buys discounts prices deals sales offers promotions products.

By law the limits below are the minimum insurance limits for a standard auto policy. 30000 for injurydeath to more than one person. Bodily Injury Liability 15000 Per Person30000 Per Accident.

Ad 4 out of 5 New Customers Recommend Progressive. State of California Department of Insurance 9 Coverage C Personal Property This coverage provides protection for the contents of your home and other personal belongings owned by you and other family members who live with you. 5000 for damage to property.

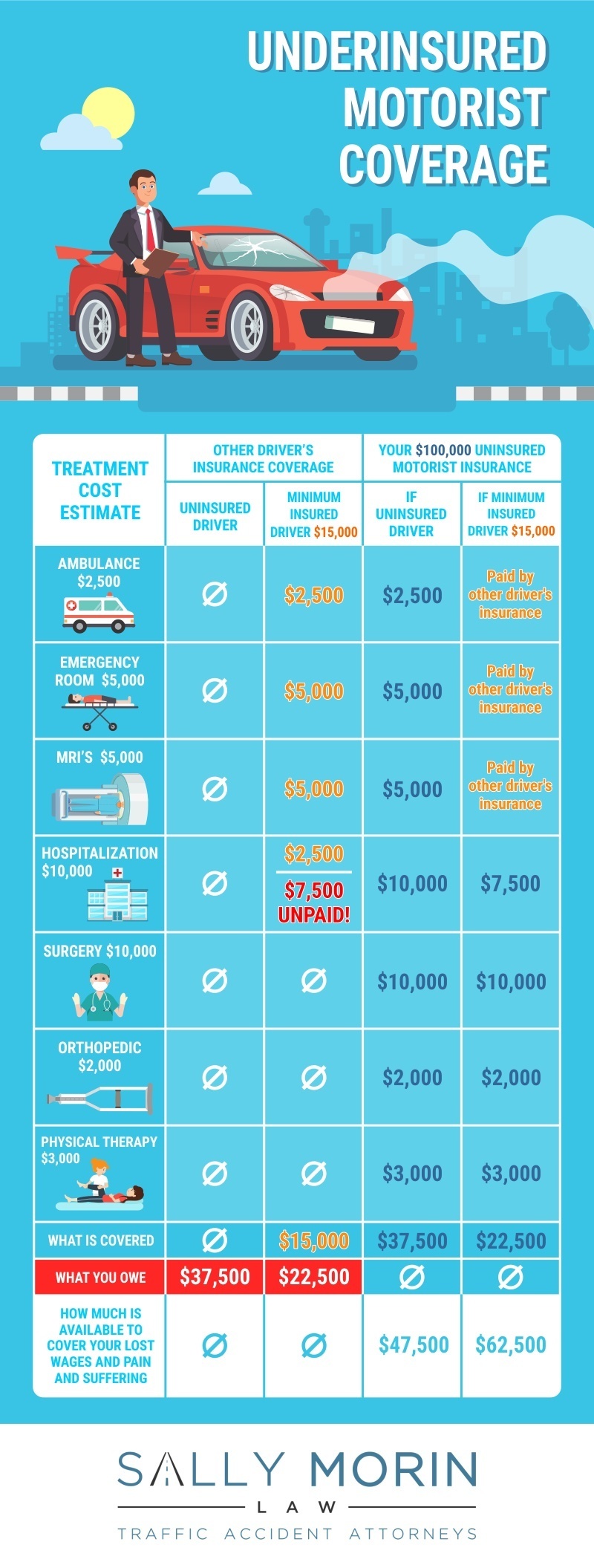

But the Bronze 60 plan will save you 300 for an individual if you experience unexpected high medical costs and you meet your deductible. 15000 for the death or injury of any one person. Uninsured motorist bodily injury coverage¹.

Switch Start Saving Today. 15000 per person 30000 per accident minimum. 25000 bodily injury per person50000 bodily injury per accident.

Now that you understand the types of car insurance its time to review the average costs of car insurance in California. Enroll Online or By Phone Today. Ad Get Started Now by Choosing the Right Coverage Using our Car Insurance Calculator.

Property damage liability coverage. Bodily Injury Liability Coverage per person 25000 50000 for injuries resulting in death Bodily Injury Liability Coverage per accident 50000 100000 for injuries resulting in death Property Damage Liability. 15000 per person30000 per occurrence.

15000 per person 30000 per accident minimum. Compare Multiple Rates Side By Side On The 1 Website for Ease of Use. If one person is injured in the accident your coverage.

The average cost for the minimum required coverage is 574 per year or 48 per month. Is it mandatory to have car insurance in California. Ad Miss the Jan 31st Deadline.

Bodily injury liability coverage. Minimum California Car Insurance Coverage. California Auto Insurance Law Minimum Amount of Car Insurance So how much car insurance do you need in California.

Insurance Options For 26 Year Olds In California

Sr 22 Insurance In California What Is It How Much Does It Cost Valuepenguin

Individual Health Insurance Plans Quotes California Hfc

How Much Car Insurance Do You Need And How Much Is Required Moneygeek Com

Health Insurance Companies In California Covered California

Full Coverage Car Insurance Cost Of 2021 Insurance Com

Metallic Plan Benefits Covered California Health For Ca

Auto Insurance Requirements California Dmv

What Is California Care Health Insurance Hfc

California Minimum Car Insurance Everything You Need To Know

The Price Of Used Car Insurance And Where To Get Your Best Deal Valuepenguin

Car Insurance 101 Car Insurance For First Time Drivers

Auto Insurance Types And Purpose Of Coverage

Best Cheap Health Insurance In California 2021 Valuepenguin

Covered California Income Tables Imk

How Much Uninsured Motorist Insurance Should I Get

Minimum Essential Coverage Mec Health For California

Posting Komentar untuk "Minimum Insurance Coverage California"