Terrorism Insurance Coverage Definition

The Terrorism Risk Insurance Act TRIA HR. 1 be a violent act or an act that is dangerous to.

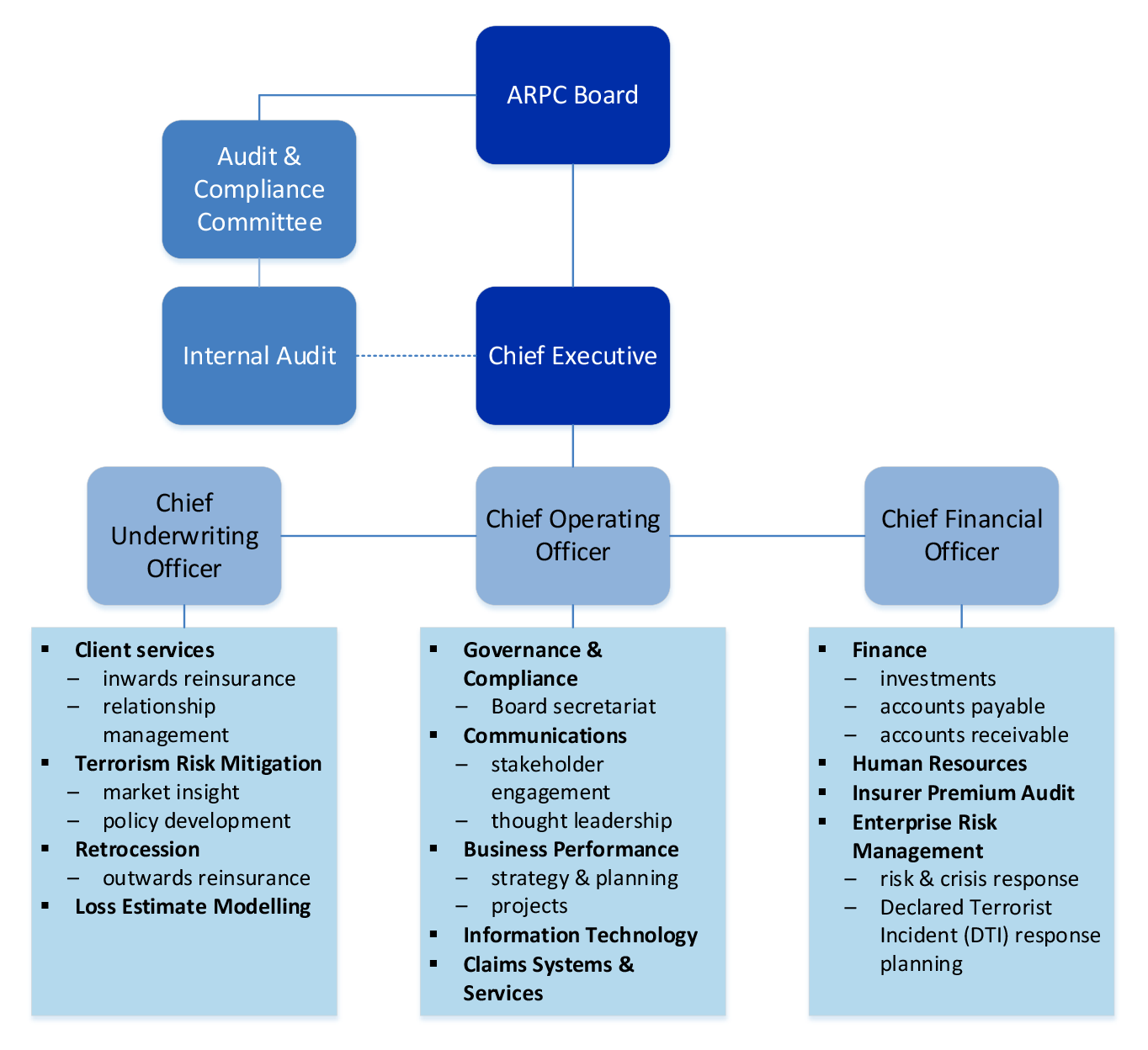

Management Of The Terrorism Reinsurance Scheme Australian National Audit Office

Risk managers wrestle with terrorism insurance options.

Terrorism insurance coverage definition. The term act of terrorism means any act that is certified by the Secretary of the Treasury in accordance with the provisions of the federal Terrorism Risk Insurance Act to be an act of terrorism. Terrorism coverage is a publicprivate risk-sharing partnership that allows the federal government and the insurance industry to share losses in the event of a major terrorist attack. Terrorism Insurance typically covers equipment furnishings inventory and buildings damaged or destroyed by terrorist acts and protects businesses against liability claims.

Certified Act of Terrorism a terrorist act that is eligible for coverage under the Terrorism Risk Insurance Act TRIA. Terrorism is a grave risk that is being faced by the entire world. Some companies presume that if a type of loss is not excluded by their insurance policy its insured.

Terrorism Insurance insurance covering loss due to acts of terrorism. Many insurance policies neither explicitly cover nor exclude many of the losses arising from such terrorism events. Terrorism risk insurance typically provides protection against property that is damaged or destroyed including buildings and contents such as inventory and equipment and the resulting business interruption.

A definition will appear within a policyholders policy but this will vary depending on the insurance. Primary excess or quota share participation. The definitions of terrorism under various insurance policies for the purposes of deciding whether the terrorism exclusion applies or not can vary and are not.

While property insurers must offer terrorism coverage this provision may have the effect of pricing themselves of the market. There is no single agreed definition of terrorism. Once viewed as a rarely needed insurance solution standalone property terrorism insurance is now an integral part of a comprehensive risk management program.

Global insurance coverage for terrorism war and political violence. The Terrorism Risk Insurance Act of 2002 TRIA Pub. Prior to 911 standard commercial insurance policies included terrorism coverage effectively free of charge.

107297 text pdf is a United States federal law signed into law by. Definitions of Terrorism. Insurers who write workers compensation business are obligated to provide statutory benefits to injured workers.

TRIA was initially created as a temporary three-year federal program allowing the federal government to share monetary losses with insurers on commercial property and casualty losses due to a terrorist attack. When an event related to terrorism occurs the losses faced by certain individuals or groups of individuals are catastrophic. When evaluating the value of Terrorism Insurance to your business make.

Backed by its global capabilities AIG Canadas coverage goes beyond government-mandated limits and offers industry-leading protection against terrorism and political violence. Terrorism Risk Insurance Act. Federal law enacted in 2002.

Global capability with underwriting hubs in London Singapore and the US. The TRIA was enacted in the wake of the terrorist attacks of September 11 2001. The Terrorism Risk Insurance Act TRIA which was enacted by Congress in November 2002 ensures that adequate resources are available for businesses to recover and rebuild if they are the victims of a terrorist attack.

It is considered to be a difficult product for insurance companies as the odds of terrorist attacks are very difficult. An Act to ensure the continued financial capacity of insurers to provide coverage for risks from terrorism. But after 911 concerns about the limited availability of terrorism coverage in high-risk areas and its impact on the economy lead Congress to pass the Terrorism Risk Insurance.

To qualify as a certified act of terrorism the incident must. Terrorism attacks using vehicles have raised questions over who is responsible for compensating innocent victims. 2322 established a temporary federal program providing for a shared public and private compensation for insured losses resulting from acts of terrorism.

Terrorism insurance is insurance purchased by property owners to cover their potential losses and liabilities that might occur due to terrorist activities. Specialized underwriters who understand applicable legislation like TRIPRA. The loss of human life is an obvious and sad outcome of terrorist attacks.

It was created to enable commercial insurers to provide reasonable terrorism coverage to policyholders who are subjected to acts of terrorism. In response Congress passed the Terrorism Risk Insurance Act or TRIA in 2002. Sifting through what insurance is available and determining what coverage is needed is just one of the after effects the multifamily housing industry must address in the wake of the September 11 attacks.

Terrorism insurance coverage can provide compensation for destruction injury or loss-of-life that is caused by certain destructive acts foreign or domestic that are declared to be acts of terrorism by the US. You are hereby notified that under the federal Terrorism Risk Insurance Act as amended the Act you have a right to purchase insurance coverage for losses arising out of acts of terrorism as defined in Section 1021 of the Act. The Terrorism Risk Insurance Act TRIA is a US.

Unless endorsed to exclude loss due to terrorism commercial insurance policies issued in the United States for example commercial property policies commercial general liability CGL policies and commercial auto policies generally provide terrorism insurance. Coverage can also be extended to include terrorism-related liability claims against organizations arising from loss of life and injury. Standard market or bespoke wordings.

Terrorism Risk Insurance Act. Such acts are certified by the Secretary of the Treasury applying criteria spelled out in TRIA.

Terrorism Insurance Cover Deacon

International E Platform On Terrorism Risk Insurance Oecd

Understanding Terrorism Insurance Iii

Property Insurance For Management Agents Deacon

Terrorism Insurance Cover Deacon

Pdf Cyber Terrorism Assessment Of The Threat To Insurance

Terrorism Insurance Speak To Howden About Rationalising Your Risk Howden Belgium

Pwg Report On The Future Of Terrorism Insurance Expert Commentary Irmi Com

Management Of The Terrorism Reinsurance Scheme Australian National Audit Office

Posting Komentar untuk "Terrorism Insurance Coverage Definition"