Life Insurance Length Of Cover Meaning

Term policies may be renewed after they end. Decreasing-term is best for those who wish to be covered for the remaining mortgage repayment on their home so that loved ones can cover the balance of their home when they pass away.

What Is Term Life Insurance Money

If you have a mortgage you need to ensure that the term of the mortgage is covered ie the term of the life insurance policy matches the remaining term of your mortgage.

Life insurance length of cover meaning. Life insurance explained. Policy Loan A loan a life insurance company makes to a policy owner. With the former you pick how long you want insurance to last for and how much you want it to pay out.

Typically lower than whole life. If the life insured dies during the term the death. With level term cover if you live longer than the policy term there is no payout.

Coverage length means the length of time that your life insurance policy will stay in effect. Policy The legal document issued by the life insurance company to the policyholder stating the terms of the life insurance contract. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

A type of life insurance where the sum assured is payable only in the event of death of the insurer during the specified term. As the name implies whole life insurance covers you until the day you die. These policies are considered risk-free.

Life Insurance is a financial product that could mean your loved ones receive a sum of money if you were to pass away while covered by the policy. With whole life cover. Cover for over 90s You choose how long youd like your cover to last.

So for example with a 40-year term should you die within the 40 years of the policy your loved ones will receive a cash lump sum from your insurer. Ahorra Ya Mismo en GigaPromo. Term life insurance and whole of life insurance.

Life Insurance can be termed as an agreement between the policy owner and the insurer where the insurer for a consideration agrees to pay a sum of money upon the occurrence of the insured individuals or individuals death or other event such as terminal illness critical illness or maturity of the policy. Life insurance is a contract in which an insurer in exchange for a premium guarantees payment to an insureds beneficiaries when the insured dies. Here at ICICI Prudential Life Insurance you pay premiums for a specific term and in return we provide you.

A provision in most life insurance policies that allows the life insurance company to withhold the death benefit payout if the policyholder dies by suicide within the first year or two of the policy. Level term life insurance is for a fixed amount of time usually the length of the mortgage. Typically term life insurance is issued in 5 year increments such as 10 15 20 or 30 years.

Level-term and decreasing-term are the two main types of life insurance. A life insurance policys term length is the policys duration or how long it will last until expiring. In general the duration of your life insurance will be dictated by what you want it to cover.

Generally 6x 10x more expensive than term for the same death benefit. But it is also possible to get a term life insurance policy tailored to your specific needs. Level-term life insurance is beneficial to those who have minimal debt and wish to leave their loved ones a cash sum when they die.

This is because they provide a fixed benefit Cover Amount in case of death of the insured person or at end of the term. It is up to you to choose what term you want the cover for. As a life insurance policy it represents a contract between the insured and insurer that as long as the contract terms are met the insurer will pay the death benefit of.

Term life insurance occurs over a predetermined period of time typically between 10 and 30 years. If you pass away at any time during that term your loved ones will receive the full amount. The length of the cover will affect the size of your premiums.

Usually the coverage length is referring to how long the policy will stay in effect at a level premium level meaning the premium is guaranteed not to go up. Renewal cost increases with age. More Convertible Insurance Definition.

A term length should cover all of your financial obligations and outstanding debts. To provide financial protection for those closest to you in the event of your death. A life insurance policy that provides coverage until the death of the insured person.

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. Traditional Life Insurance plans offer multiple benefits in terms of life cover and returns thus providing safety and security to the insured. Length of time or term that you choose to have term life insurance coverage.

Life Insurance can be defined as a contract between an insurance policy holder and an insurance company where the insurer promises to pay a sum of money in exchange for a premium upon the death of an insured person or after a set period. Whole life insurance or whole of life assurance sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date. Suicide is still covered by life insurance if the insured dies outside of the defined term in the policys suicide clause the insurance company will pay out the death benefit.

Cost stays the same for life. Ad Encuentra y Compara Cheap Insurance en Línea. With term life insurance you have life insurance cover for a specified amount of time.

But as cash value builds it can be used to supplement premiums. In the case of survival the contract expires and the premium is not. How long should I get life insurance for.

A Life Insurance only policy can provide cover up until your 90th birthday. The length of your life insurance policy will be personal to you and should be based on the reason you need the cover. Length of CoverageTerm Length.

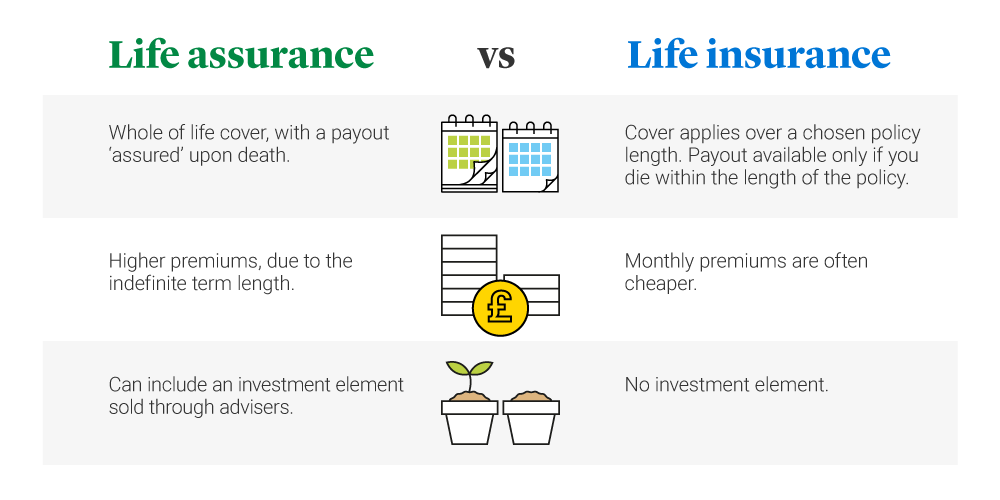

In broad brushstrokes there are two main types of life insurance you need to know about. However if you add on Critical Illness Cover the Life Insurance policy can only provide cover until youre 70 years old. Most term life insurance policies are 10 20 or 30 years but many companies offer additional five- or 10-year increments sometimes up to 35- or 40-year terms.

For most people there are two main reasons you might want to take out a life insurance policy. To help protect a mortgage.

Love My New Tattoo O Pretty Tattoos Beautiful Tattoos Ink Tattoo

Dios No Resta Ni Divide Dios Suma Y Multiplica Dios Multiplicar Palabra De Dios

18 Makeup Tips For Girls Who Don T Know How To Use Eyeliner Gurl Com Como Maquillar Ojos Almendrados Maquillaje De Belleza Maquillaje Increible

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Hair Updos For Occasions Fashion Life Styles Hair Styles Hair Color Purple Medium Hair Styles

How To Write Cover Letters In Three Easy Steps Cover Letter For Resume Sample Resume Cover Letter Job Cover Letter

How Does Whole Life Insurance Work Costs Types Faqs

Language Translation Process For Professional Translators Use Language Translation Translation Process Language

Cinema 4d Hair Attractor Cinema 4d Cinema 4d Tutorial Digital Art Tutorial

Understanding The Life Insurance Medical Exam Policygenius

Pin By Valeria Natalie On Accessorize Earrings Jewelry Beautiful Jewelry

Starlife Assurance Print Advert By Telemedia Don T Let Life Get In The Way Ads O Life Insurance Marketing Ideas Life Insurance Marketing Insurance Marketing

Whats So Trendy About How Did Mexico Get Its Name That Everyone Went Crazy Over It How Did Mexico Get Its Nam Mexico Flag Meaning Mexican Flags Mexico Flag

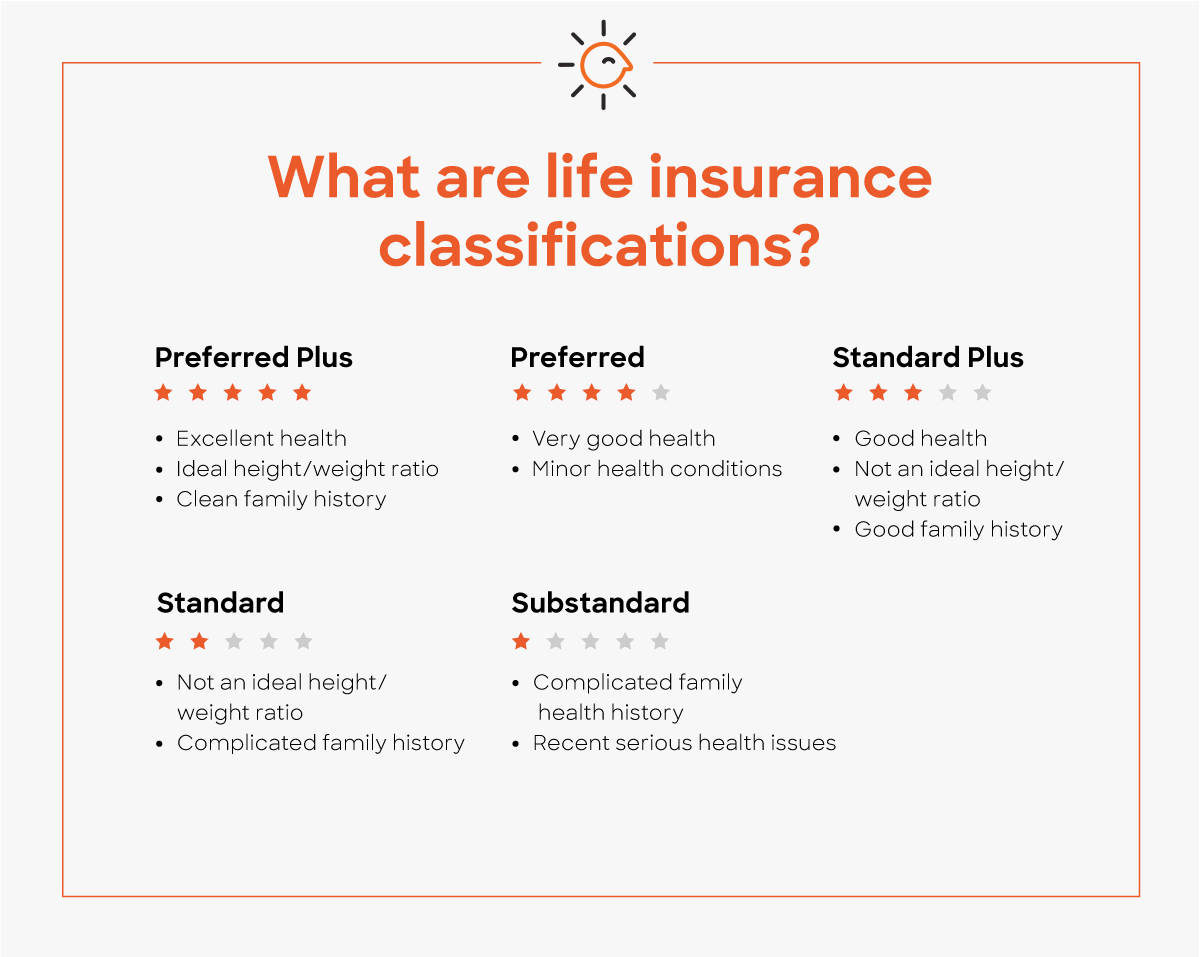

Life Assurance Vs Life Insurance Legal General

Https Bohouti Blogspot Com 2020 08 Faqs Salama Car Insurance Html Car Insurance Insurance Salama

Term Life Insurance Explained Forbes Advisor

How Does Life Insurance Work Forbes Advisor

Posting Komentar untuk "Life Insurance Length Of Cover Meaning"