Is Losing Coverage A Qualifying Event

Losing eligibility for Medicare Medicaid or CHIP. Because the incarcerated individual has had a change of residence affecting hisher access to coverage under the plan just as if heshe had moved outside of an HMO service area we have a qualifying event.

Health Insurance Application Process

These qualifying events give you the opportunity to sign up for a new health insurance plan or modify an existing health insurance plan outside the traditional Open Enrollment Period.

Is losing coverage a qualifying event. Luckily as long as it wasnt voluntary your loss of coverage is a qualifying life event according to Covered California. This means you have sixty days from when you lost coverage to enroll in a new plan. If you buy a plan through the governments Marketplace you have a 60-day period from the time of a qualifying life event.

Therefore you would not be eligible for a special enrollment period if you wanted to. Loss of Coverage Due to the Death of the Covered Spouse. Declining Marketplace Insurance Declining individual marketplace open enrollment coverage is considered a qualifying life event to enroll in company coverage by many carriers.

There are 4 basic types of qualifying life events. This means you have sixty days from when you lost coverage to enroll in a new plan. And youll have more options flexibility and control of your health plan outside of COBRA with an individual health insurance plan.

Failure to Pay Insurance Premium Not a COBRA Qualifying Event. She will qualify for a loss of coverage SEP for herself when the unborn child CHIP coverage. Is voluntary loss of coverage a qualifying event.

Whatever the case is losing coverage due to divorce or legal separation is a qualifying life event that makes a former spouse eligible for an open enrollment period. For example if a spouse chooses to decline coverage through their companys open enrollment they can be added as a dependent to the employees plan in Zenefits. Or 3 the date on which you are informed through the furnishing of either the SPD or the COBRA general notice of the responsibility to notify the plan and procedures for doing so.

Rolling off of COBRA coverage is a qualifying event that opens a special enrollment period for you to purchase your own health coverage. The following are examples not a full list Loss of health coverage. Luckily as long as it wasnt voluntary your loss of coverage is a qualifying life event according to Covered California.

Is starting a new job a qualifying life event. Losing coverage in any way possible will make you eligible for a qualifying event. These types of coverage are not minimum essential coverage but people who lose coverage under these plans do qualify for a special enrollment period this includes a woman who has CHIP unborn child coverage for her baby during pregnancy but no additional coverage for herself.

Is loss of coverage a qualifying event. Losing job-based coverage when you leave your current employment either voluntarily or involuntarily. Failure to pay the health insurance premium or the employees portion of such can result in discontinuation of coverage for the employee.

1 the date on which the qualifying event occurs. A qualifying life event is a change in your family status or health insurance needs thats serious enough to require a change in your health insurance coverage. Whether you are losing coverage through your parents insurance whether you are not eligible for Medicaid or whether you have lost your employer based coverage it does not matter.

2 the date on which you lose or would lose coverage under the plan due to the qualifying event. Certain changes in your life situation are known as qualifying life events like a loss of health coverage a change in your household or a change in residence. Typically in order to enroll it would have to be during an open enrollment period.

Qualifying Life Event QLE A change in your situation like getting married having a baby or losing health coverage that can make you eligible for a Special Enrollment Period allowing you to enroll in health insurance outside the yearly Open Enrollment Period. Yes a spouse changing employers is usually considered a qualifying life event. Is my spouse losing coverage a qualifying event.

Is gaining coverage a qualifying event. Similarly the end of incarceration would be a qualifying event that would allow the individual to be added back onto the plan. Generally losing coverage because you did not pay your monthly premium is not considered a qualifying life eventThere are quite a few different life events that allow you to purchase health insurance midyear.

If your spouse loses health insurance when changing jobs and you were covered as a dependent on that plan losing that coverage is a qualifying life event that makes you eligible to get coverage at Healthcaregov or your state health insurance marketplace. Typically in order to enroll it would have to be during an open enrollment period. Turning 26 and losing coverage through a parents plan.

Lets say that you have an employee who is on an FMLA leave of absence but is failing to pay their employee share of the health insurance premium. There is an exception for pregnancy Medicaid CHIP unborn child and Medically Needy Medicaid. Losing existing health coverage including job-based individual and student plans.

Other qualifying life events are loss of individual and student plans. 2020 was the deadliest year in our history. In most situations losing coverage is considered to be a qualifying event.

Is Losing Coverage Due to Nonpayment a Life Event. Heres the good news. Being denied or losing coverage for Medicare Medicaid or Childrens Health Insurance Plan CHIP.

You can voluntarily drop your COBRA coverage or stop paying premiums on a COBRA policy but it is important to know that this would not be considered a qualifying life event.

Qualifying Life Event Special Enrollment Period Under Obamacare

If You Lost Health Insurance You May Apply For Marketplace Coverage Today Healthcare Gov

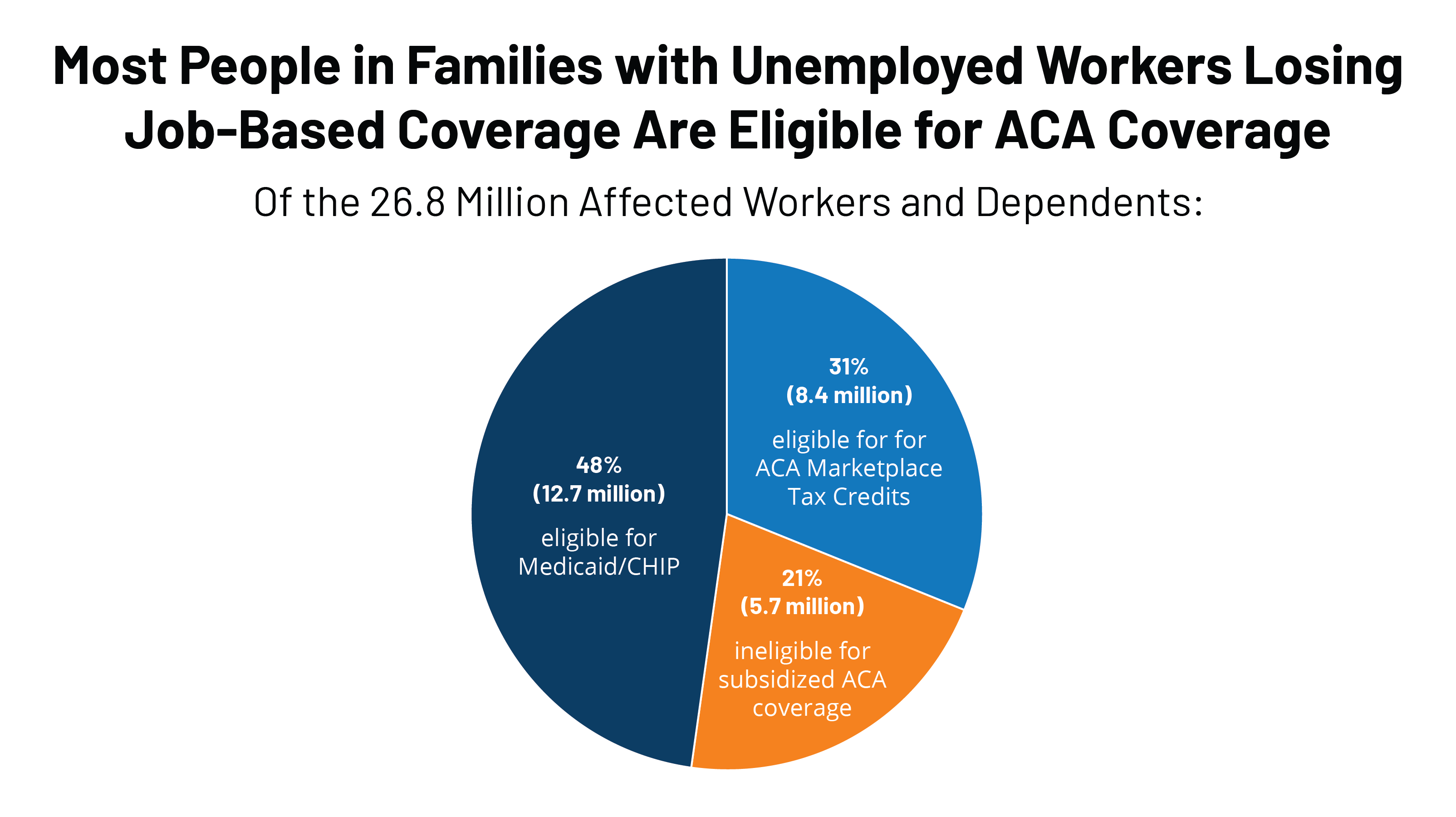

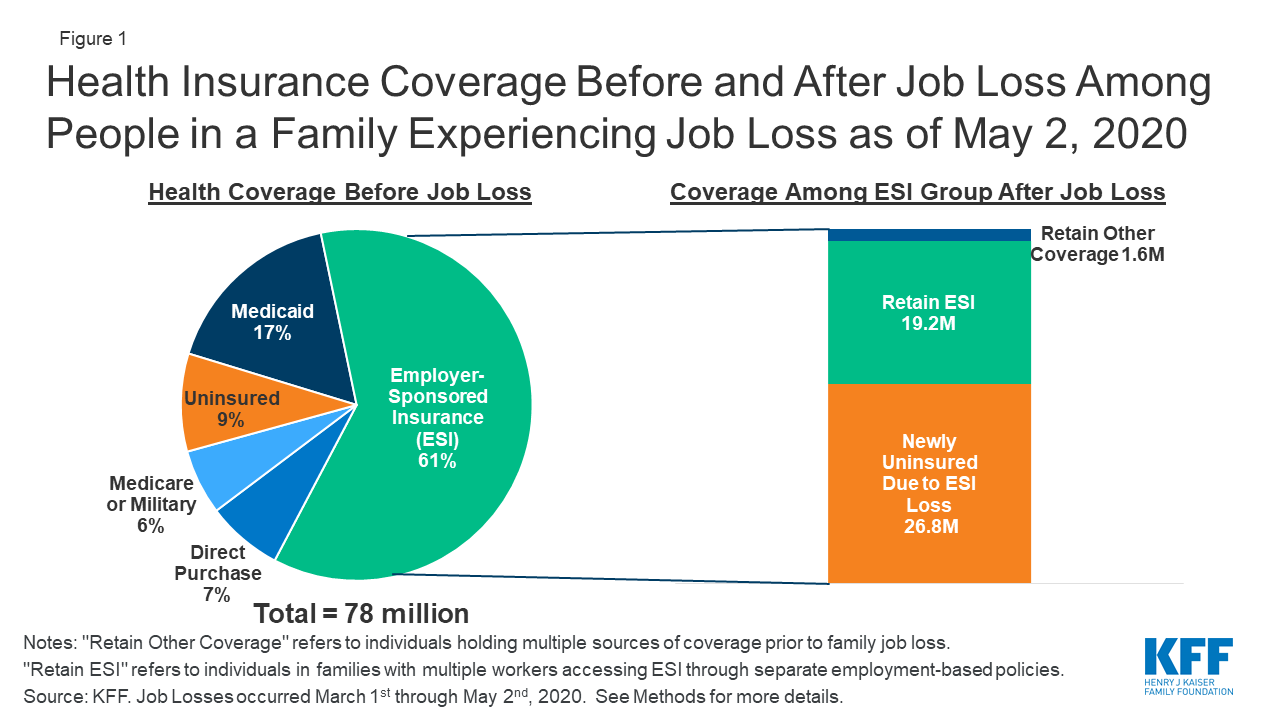

Eligibility For Aca Health Coverage Following Job Loss Kff

Need Health Insurance Young Invincibles Changing Jobs Lost Job Job Seeker

What Is An Irs Qualifying Event For Health Insurance Valuepenguin

Health Insurance For Unemployed Individuals What Are Your Options Healthmarkets

What People And Policymakers Can Do About Losing Coverage During The Covid 19 Crisis Kff

Best Buy Insurance Macon Ga How Much Medical Evacuation Insurance To Buy Who Can Buy Long Term Care Insurance Qualifying Event Buy Health Insurance Insurance Long Term Care Insurance Dental

Qualifying Life Events That Will Trigger A Special Enrollment Period

If You Experience A Significant Life Change You May Be Able To Sign Up For Heal Dental Insurance Plans Life Insurance For Seniors Marketplace Health Insurance

What To Do If You Missed The Deadline To Get Health Insurance Medical Insurance Health Insurance Coverage Health Insurance

What Employers Need To Know About A Qualifying Life Event

Individual Health Insurance 101 Individual Health Insurance Health Insurance Plans Health Insurance

Eligibility For Aca Health Coverage Following Job Loss Kff

5 Must Dos You Need To Do If You Are Laid Off From Your Job Job Career Advice Advice

Pin By Jessa Phillips On Healthcare Health Insurance Coverage Healthcare Marketplace Health Care

Changes In Income And Health Coverage Eligibility After Job Loss Due To Covid 19 Background 9345 Kff

Short Term Vs High Deductible Plans High Deductible Health Plan Health Insurance Options Affordable Health Insurance

Posting Komentar untuk "Is Losing Coverage A Qualifying Event"