Car Insurance Coverage Explained India

This is motor insurance that needs to be taken for any private car owned by an individual and is mandated by the Government of India. This cover helps you receive a higher claim amount by freeing you from the liability of bearing.

Best Life Insurance Companies For 2021 65 Reviewed Best Life Insurance Companies Life Insurance Companies Life Insurance Quotes

As per the Motor Vehicles Act third-party insurance is mandatory for every car.

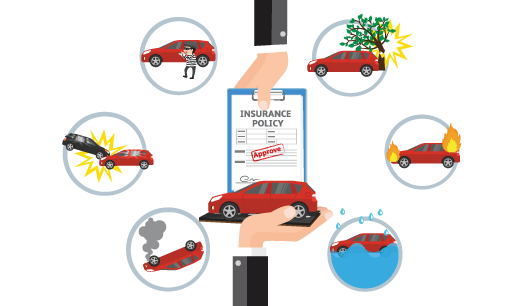

Car insurance coverage explained india. For an exact list of coverage refer to the respective Policy Wordings. It could pay for your hospitalisation - Some car insurance companies in India offer personal accident cover for the owner-driver along with the third-party liability insurance plan. In India there are two types of car insurance policies Third-party Insurance and Comprehensive Insurance.

An insurance premium will be more or less expensive and cost can vary depending on the type of coverage you are looking for as well as the risk. In India car insurance is broadly divided into two categories. Therefore if your car is not self-driven you need to buy a cover for your driver under the Workmen Compensation Act.

This covers third party liability for bodily injury liability and or death and property damage. There are two types of Car Insurance in India. Loss or damage to your car from manmade calamities like theft riot strike damage in transit.

This cover loss or damage to the vehicle insured in addition to 1 above. When you take a Liability Only Policy then the loss or damage to your car will not be. Provides legal cover and financial assistance during times of sudden unfortunate.

It covers the vehicle for damages against accidents fire natural disasters theft among others and also covers for any injury to the owner. The insured person has to pay the premium to the company. It covers only damages to the third-party.

Heres the answer to what does car insurance cover in India. Types of CarAuto Insurance in India Third-Party Insurance. United India car insurance has a claim settlement ratio of about 9172 its policies also offer discounts to companies that install anti-theft devices on their cars.

Indias Motor Vehicle Act-Section 157 makes it mandatory for the owner to transfer car insurance for a second-hand car to their name within 14 days of purchase. Car insurance policyis taken by the owner to protect her vehicle from damages andor loss arising from unavoidable and unforeseen circumstances. Have a tendency make mistake of missing lesser-known smaller insurers as they are able often provide better considerably more personalized customer care as opposed to corporations.

The insurance policy has details about the terms and conditions under which the insurance can be claimed by the insured person. This is a very useful insurance cover as it pays for minor or serious injuries that the car owner suffers in an accident. It is crucial to own a basic cover of car insurance as it is regarded as a compulsion as per the Indian Motor Tariff.

With third-party insurance you are only protected against the damages losses or injuries caused to the third party in case of a road accident involving your car. It covers important car-related incidents such as accident theft or any kind of accident and to protect yourself from financial loss from such accidental incidents. Benefits of Third-Party Insurance.

Third-party insurance is a mandatory requirement by law. How to choose the best car insurance company in India. In India two types of car insurance plans are offered.

It is a type of car insurance plan that offers limited coverage. Car insurance is a type of insurance to compensate for the loss of the policyholder and also of the third party depending on the types of car insurance plans. Comprehensive Insurance cover- It offers cover against damage done to the vehicle death of driver or passengers and damage caused by the vehicle to a.

Personal Accident cover for Owner-driver is also included. This cover insures you against the depreciation applicable on your car and its plastic and metal parts at 100 except tyres tubes and batteries which are covered at 50. There are two aspects of such a policy third-party and own damage.

Third-party Car Insurance Coverage. It provides cover against theft totalpartial damage caused to the vehicle. Car Insurance Explained India 1 in the first steps when you get inexpensive online car insurance is actually discussion quotes and researching the businesses that offer the procedures.

The size and premium for this cover are both fixed-- Rs 2 lakh coverage for a nominal price of Rs 50 excluding service tax. Loss or damage to your car from natural calamities like fire lightning flood hurricane. As the name suggests it offers.

The standard motor cover is applicable only in India. Click on the link below to know more about the company. Different Types of Car Insurance - Car insurance is a tool meant to protect you against the financial losses which may occur due to an accident or any unfortunate event involving your car.

The insurance coverage under this policy includes coverage against third party legal liability. What is Liability Only Insurance Cover in Motor Insurance. Liability Only Policy is mandatory as per the Indian legal system - it is a Statutory requirement.

Browse United India Car Insurance Plans Now. Liability only policy. However before opting for an insurance.

Type of Car Insurance. Third Party liability Insurance cover. Third-Party Insurance- Third-party insurance is a basic vehicle insurance As per applicable terms and conditions it covers bodily injuries damage s or losses caused to any third-party vehicleproperty by.

Comprehensive Car Insurance Coverage. This policy will cover the third-party individual who has been involved in the accident caused by you.

Motor Insurance Compare And Buy Vehicle Insurance Plans Online

Comprehensive Insurance Vs Third Party Car Insurance Comparison

Get Car Insurance Quotes In 2020 Insurance Quotes Auto Insurance Quotes Car Insurance

Car Insurance Online Compare Buy Renew Car Insurance Policy In India

Most Filipinos Think That Getting A Car Insurance Policy Is Just An Option For Vehicle Owners Y Car Insurance Car Insurance Online Comprehensive Car Insurance

A Comprehensive Car Insurance Cover Protects Against The Losses Caused By Damage To Your Vehicle Life Insurance Facts Car Insurance Facts Life Insurance Policy

List Of Add On Covers In Car Insurance Buy Online

What Is Motor Insurance Know The Importance Of Motor Insurance Abc Of Money

4 Common Mistakes People Make And End Up Overpaying For Car Insurance Auto Insurance Quotes Car Insurance Renew Car Insurance

Car Insurance In Pakistan Car Insurance Insurance Compare Insurance

196 Reference Of 0 Depth Car Insurance Meaning In Hindi Car Insurance Insurance Comprehensive Car Insurance

Pin On Alfred S Insurance Market

A Comprehensive Car Insurance Cover Protects Against The Losses Caused By Damage To Your Vehicle But How Car Insurance Facts Best Car Insurance Car Insurance

Common Exclusions Of Your Health Insurance Policy Health Insurance Health Insurance Plans Best Health Insurance

Get Free Add Ons And Other Benefits With Our Car Insurance Plans Click This Link To Know More Https Travel Health Insurance Car Insurance Travel Insurance

Third Party Vs Comprehensive Car Insurance 09 Oct 2021

Posting Komentar untuk "Car Insurance Coverage Explained India"