Health Insurance Coverage While On Long-term Disability

It doesnt even matter if you wait to file your claim until after the policy ends as long as the onset date happens while youre still insured you can potentially get benefits. Of course its not quite that.

Long Term Disability The Ultimate Guide 2021 Resolute Legal Disability Lawyers

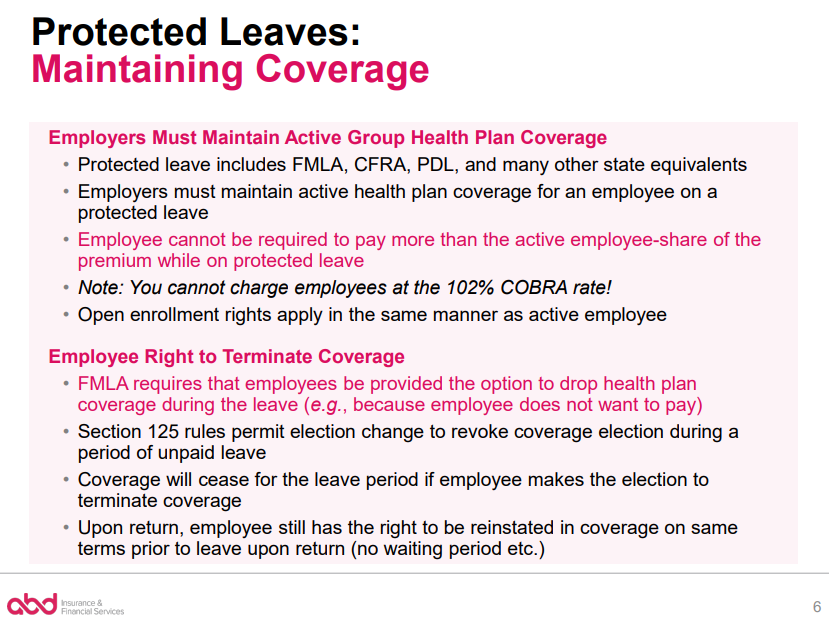

So unless the employer plan provides for more generous coverage of employer-subsidized medical insurance under the short-term disability or long-term disability plans the employer must provide the coverage for up to 12 weeks.

Health insurance coverage while on long-term disability. Ad Trusted International Health Network with Perfectly Tailored Plans from Cigna Global. The Family Medical Leave Act FMLA requires that employers continue to provide health insurance coverage on the same basis as if the employee was working. There are two types of disability policies.

There are two key laws that may protect your rights while you are unable to work. Get the Best Quote and Save 30 Today. Dental andor Extended Health.

Group Life Accidental Death and Dismemberment and Long Term Disability. Fraser Health will continue to pay the Group Life and Accidental Death and Dismemberment contributions and will provide you with an annual T4 as these are taxable benefits. Employers who offer coverage may provide short.

As long as your disability onset date happened before your insurance ended the insurer is legally required to cover you. Long term disability insurance is a type of income protection that is designed to cover serious injuries and illnesses that keep you out of work for three months or longer. Short-term policies may pay for up to two years.

Indeed we inform our clients receiving LTD benefits that their employment is likely to be terminated at some point. Most last for a few months to a year. There are 9 questions you should ask yourself about your group health coverage and needs to help you make the right decision about COBRA benefits.

I expect to return to my old job after that. Your coverage will continue if you choose to pay 50. What is long term disability considered.

Employers cannot terminate health insurance coverage for any employee while they are on disability leave. Long Term Disability benefits from a private insurer ie not SSDI are not health insurance so they are not as far as I. Ad Contact Our Responsive Insurance Advisors.

However this does not mean that you will keep your employment throughout your disability. Long-term policies may pay benefits for a few years or until the disability ends. If you have a special health care need like if youre terminally ill need help with daily activities get regular care at home or in another community setting live in a long-term care facility or group home or have a condition that limits your ability to work or if you have a disability you have a number of options for health coverage.

Long term disability applicants often lose their employer provided health insurance coverage as a result of their disability. Health coverage while on long term disability. Looking After Your Health And Well-Being In These Unsettling Times Is Our Priority.

The length of the elimination period has a direct impact on the LTD premium as a longer elimination period will result in fewer claims. Hi I am undergoing a medical treatment which has made me go on disability leave. Will their benefits end.

Get the Best Quote and Save 30 Today. Ad Contact Our Responsive Insurance Advisors. Yes your employer can cancel your health insurance while on disability.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. - Free Quote - Fast Secure - 5 Star Service - Top Providers. Ad Trusted International Health Network with Perfectly Tailored Plans from Cigna Global.

Ad Compare Top Expat Health Insurance In Laos. First the Family and Medical Leave Act protects employees from losing coverage while off of work as long as they have a legitimate medical reason to be on leave that is backed by a physicians word. Ad Compare Top Expat Health Insurance In Laos.

You meet the requirements for getting disability. This includes permanent disabilities that leave you unable to return to work. For plans that include a Short Term Disability benefit the Long Term Disability plan is designed so that the elimination period ends and benefits begin as soon as Short Term Disability benefits cease.

If a LTD plan is offered through your employer it is very important to sign up during the initial enrollment period when you cannot be denied coverage for a pre-existing condition. Your coverage will continue while you are on a long term disability claim. Typically long-term disability LTD benefits can be paid through age 65 or 67.

I just got approved for long term disability and expect to remain so for next 2-3 months. Looking After Your Health And Well-Being In These Unsettling Times Is Our Priority. Long Term Disability coverage provides wage replacement that is between 50-70 percent of your earnings before a non-work related injury impacted your ability to work.

In general COBRA applies to health insurance.

Individual Life Insurance Vs Group Term Life Insurance Fbs Life Insurance Facts Term Life Term Life Insurance

Buy The Right Disability Insurance For Proper Coverage Family Life Insurance Life Insurance Policy Disability Insurance

How Much Health Insurance Cover You Need Find Out Health Insurance Life Health Insurance Health Insurance Policies

Short Term Vs Long Term Disability Insurance Disabilityinsurance Insurance Term Life Insurance Quotes Life Insurance Quotes Long Term Disability Insurance

What Would You Do If You Were Disabled And Couldn T Work Have You Thought About Protecting Life Insurance Quotes Life Insurance Facts National Life Insurance

Terminating Health Benefits For Employees On Disability Leave Newfront Insurance And Financial Services

Health Insurance Rights During Medical Work Leave

Term Insurance Calculator Helps You To Calculate Online Term Insurance Premiu Life Insurance Calculator Health Insurance Infographic Life Insurance For Seniors

Perfect Difference Between Life Insurance And Health Insurance With Table Life And Health Insurance Health Insurance Infographic Life Insurance Marketing

Benefit Options 4u Medicare Insurance In The Puget Sound Area Wa Visit Now Medicare Supplement Plans Medicare Supplement Medicare Billing

Why Disability Insurance Legacy Insurance Agency Disability Insurance Life And Health Insurance Life Insurance Agent

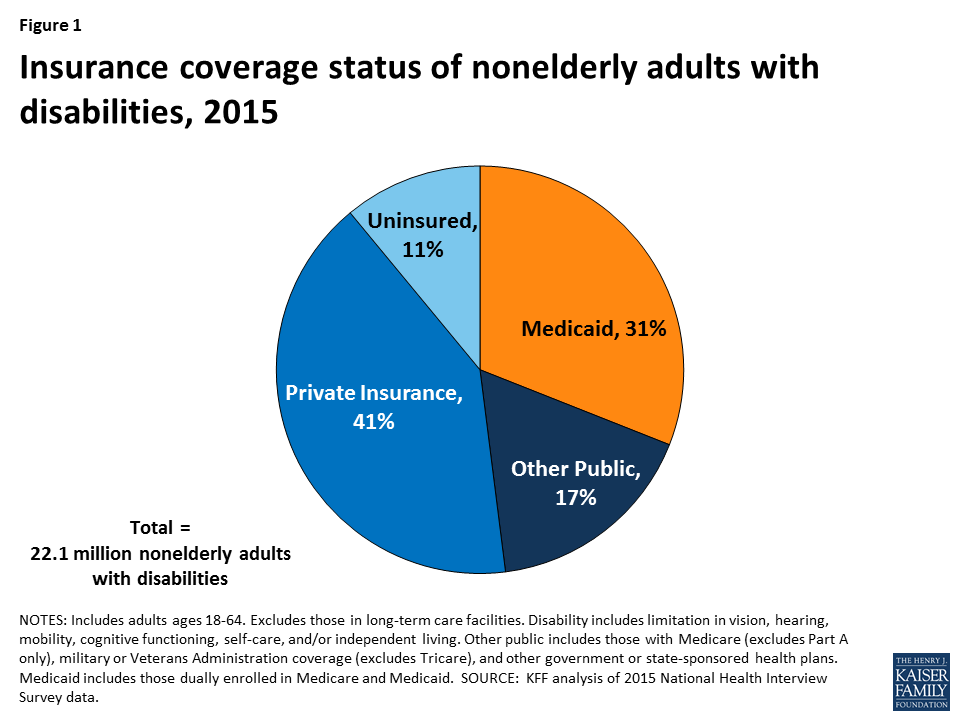

Medicaid Restructuring Under The American Health Care Act And Nonelderly Adults With Disabilities Kff

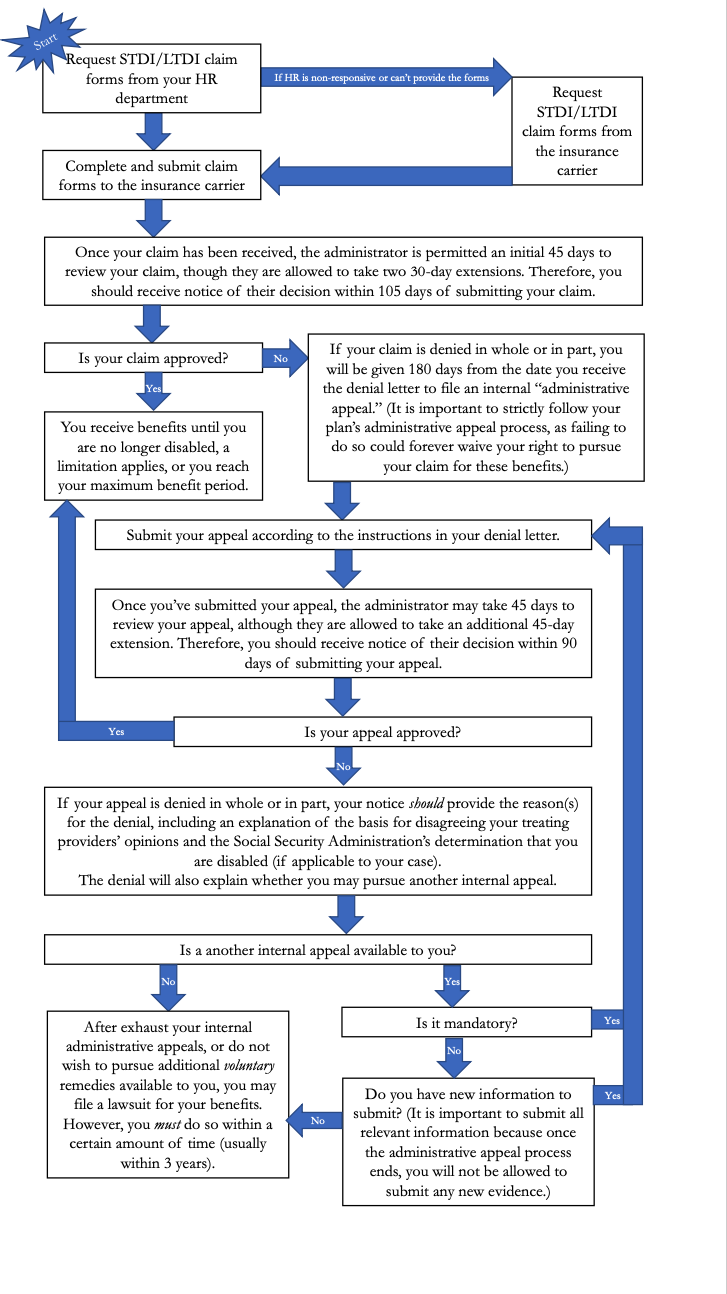

How To Claim Disability Benefits For Mental Health Conditions Hawks Quindel Website

Multitasking All The Time Neglecting Your Health In Bargain You Can T Afford Not To Be Insured Ensurehealth Ensurehappiness Health Insurance Neglect

Life Insurance Cheat Sheet Family Title C Graphic Line Shutterstock Com Calculator C Timashov S Life Insurance Calculator Life Insurance Insurance Marketing

The Difference Between Short Long Term Disability Insurance

Calculate Your Needs Life Happens Life Insurance Quotes Life Insurance Facts Life Insurance Marketing Ideas

Disability Insurance Is Coverage That Provides You With Income Protection Should You Lose Time On The Job Due Disability Insurance Income Protection Disability

Posting Komentar untuk "Health Insurance Coverage While On Long-term Disability"