Professional Indemnity Insurance Coverage Explained

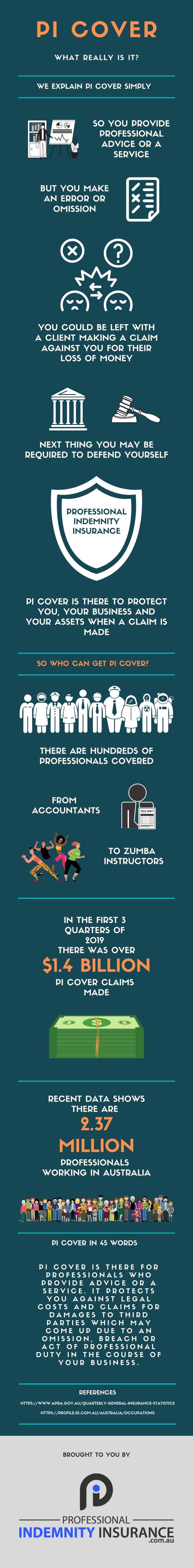

If a third party receives any harm or damage to life or property due to negligent professional practices professional indemnity insurance covers the risks caused to professionals. That said almost everyone who provides professional service or advice no matter how big or small your business may be can benefit from getting professional indemnity insurance.

Professional Indemnity Insurance Explained

Professional Indemnity insurance is to cover your legal liability for the advice and design that you provide and also ensures protection against liability for breach of professional duty that you may face when providing a service.

Professional indemnity insurance coverage explained. To get the coverage you need contact an insurance. Making a mistake in a piece of work for a client Loss of documents or data. Whether youre a doctor lawyer accountant or even IT specialist you are prone to allegations and claims of breach of duty so better be safe than sorry with professional indemnity insurance.

With lower regulatory hurdles than some other countries and a. When advice is your livelihood the right professional indemnity cover can offer peace of mind security and most importantly protect your valuable reputation. In some cases you even may be required by law to have Professional Indemnity Insurance so be careful to understand your legal obligations which vary by profession and state.

We can even help you bundle other types of business insurance with your professional liability coverage. There is no standard Protection and Indemnity insurance. Professional Indemnity insurance is designed for professionals who provide advice or a service to their customers.

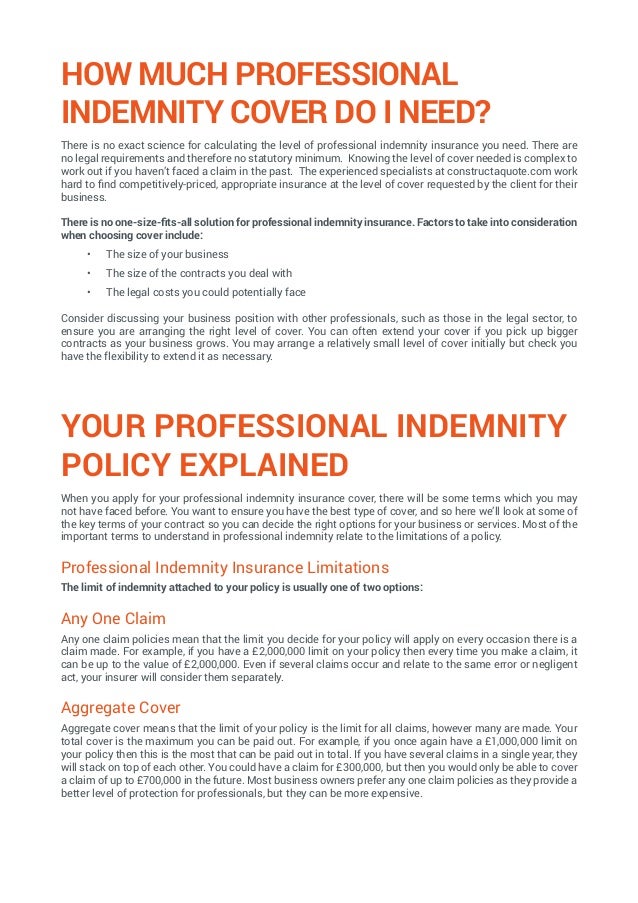

It typically covers any legal costs compensation or expenses and the cost of work to rectify the mistake should a claim be made against you or your business. Members of a single profession will get the coverage. Professional indemnity PI insurance is an important type of business insurance designed to cover you for costs you might face if your work service or advice causes clients to suffer a loss either reputationally or financially.

Warranty and Indemnity Insurance. What is Professional Indemnity Insurance. Indemnity insurance is a supplemental form of liability insurance specific to certain professionals or service providers.

Comprehensive and tailored protection against financial loss resulting from inaccuracies in warranties and indemnities relating to an acquired company or business. Australia has strong market conditions for people looking to sell their business. If someone alleges that youve made a mistake overlooked a critical piece of information misstated a fact or they have misinterpreted you in the course.

The definition of design. Professional Indemnity Insurance is an insurance policy providing risk coverage to professionals against any probable claims arising due to their mistakes or errors. Loss of goods or money your own or for which you are responsible.

Medical Malpractice Insurance helps protect medical professionals against legal liability arising from malpractice that leads to bodily injury sickness illness mental injury or death of patients. Professional Indemnity Insurance Explained 2021. Protection and Indemnity Insurance is liability insurance for practically all maritime liability risks associated with the operation of a vessel other than that covered under a workers compensation policy and under the collision clause in a hull policy.

Professional indemnity insurance one of the main forms of business insurance aims to protect you and your business from various claims made by clients and third parties whether those claims are genuine or falseIn particular it helps protect you when someone seeks compensation if youve made mistakes or are found to have been negligent. Professional indemnity insurance enables you to pursue legal avenues to clear your name and defend your reputation with the backing of a legal and insurance team. Unintentional breach of copyright andor confidentiality.

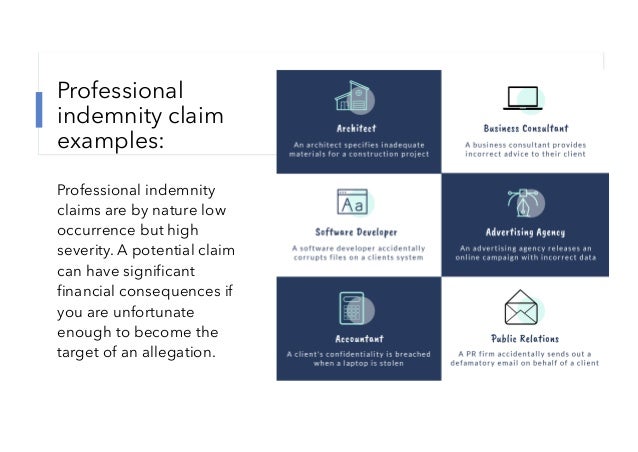

Professional Indemnity insurance is designed for professionals who provide advice or a service to their clients. Professionals who commonly turn to this type of liability insurance for coverage include architects home inspectors lawyers physicians real estate brokers and accountantsamong others. If someone alleges that youve made a mistake overlooked a critical piece of information misstated a fact or they have misinterpreted you in the course of your work resulting in a financial loss for your client they may take legal action against you to recover those losses.

Professional Indemnity Insurance on the other hand has traditionally covered intangibles such as financial loss due to faulty design poor advice or unintentional copyright infringement. This provides you with added protection against bodily injury personal injury and advertising injury errors and omissions claims examples. We were established in 2005 and today we act for over 7000 professional clients employ over 90 staff and have offices in Bristol Manchester Perth and in London opposite Lloyds at the heart of the UK insurance.

Professional Indemnity insurance protects professionals against claims of negligence or breach of duty made by a client as a result of receiving professional advice or services from your business. It protects you against legal costs and claims for damages to third parties which may arise out of an act omission or breach of professional duty in the course of your business. Professional indemnity insurance is known by many names.

Professional liability insurance also referred to as professional indemnity insurance protects professional personnel against negligence claims made by their patients or clients. Professional Indemnity Insurance helps protect professionals against legal liability for breach of professional duty in the conduct of their professional business practice. Insurance professionals provide counsel expertise or specialized services.

Professional Indemnity insurance in Australia is available for a wide range of businesses that provide specialised or expert advice for a fee. Professional Indemnity Insurance covers your legal defence fees and the. Professional indemnity insurance covers against a wide range of scenarios including.

Professional indemnity insurance enables you to pursue legal avenues to clear your name and defend your reputation with the backing of a legal and insurance team. When advice is your livelihood the right professional indemnity cover can offer peace of mind security and most importantly protect your valuable reputation. Professional indemnity insurance is not compulsory by law.

Often these professionals might also need other. Brunel Professions is one of the leading professional indemnity insurance brokers in the UK.

Professional Indemnity Insurance Compare Quotes Iselect

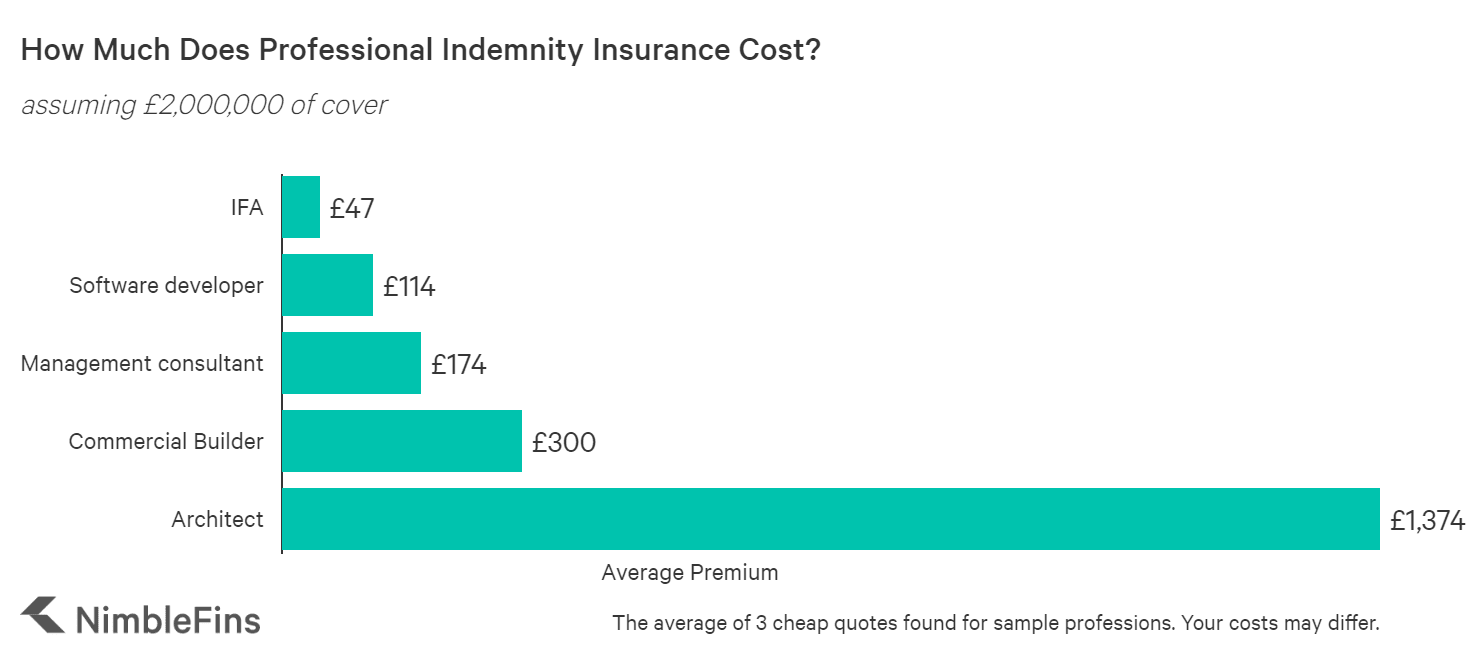

Professional Indemnity Insurance Quotes Requirements Costs Nimblefins

Protect You Against Financial Loss With Professional Indemnity Insurance Professional Indemnity Insurance Indemnity Insurance Professional Insurance

Professional Liability Insurance Is A Broad Class Of Liability Insurance Policy Int Indemnity Insurance Professional Insurance Professional Indemnity Insurance

Professional Indemnity Insurance Presentation By Get Indemnity

Professional Indemnity Insurance Presentation By Get Indemnity

Professional Indemnity Insurance Claims Examples Professional Indemnity Insurance Indemnity Insurance Indemnity

Professional Indemnity Insurance Presentation By Get Indemnity

Professional Indemnity Insurance Ultimate Guide

It Shields Me And Other Professionals Or Businesses Insurance Quotes Professional Indemnity Insurance Indemnity Insurance

Professional Indemnity Insurance Presentation By Get Indemnity

Professional Indemnity Insurance Ultimate Guide

Professional Indemnity Insurance An Ultimate Guide

Learn About Professional Indemnity Insurance Trusted Union

What Is Design And Construct Professional Indemnity Insurance Uk Insurance From Blackfriars Group

Professional Indemnity Insurance Explained Infographic

How Much Does Professional Indemnity Insurance Cost Bizcover Nz

How Much Professional Indemnity Insurance Do I Need Policybee

Analysis Of Professional Indemnity Insurance In India

Posting Komentar untuk "Professional Indemnity Insurance Coverage Explained"