How To Determine Home Insurance Coverage

Even with the best estimate your dwelling coverage limit may still fall short if you file a claim to rebuild your home. Insurance companies will provide you with a rebuild estimate based on the information submitted in your application but if you want to get a rough idea of how much your homes rebuild value is there is a simple way to do it.

Your Neighbor Could Be Paying 1 100 More Than You In Homeowners Insurance Find Out How You Could Be Paying L Content Insurance Homeowners Insurance Insurance

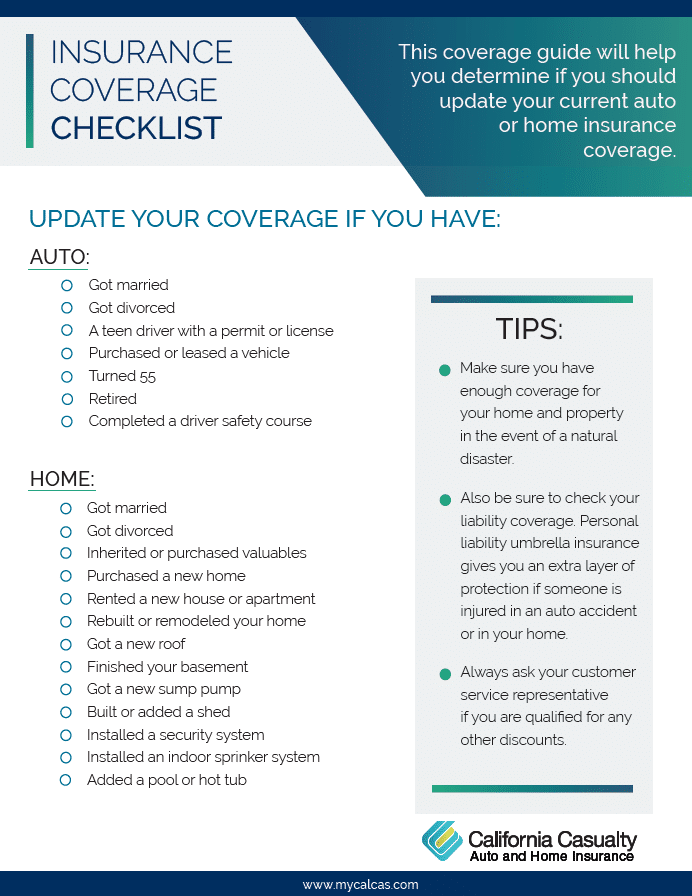

Talk with your insurance agent to find out if you have the right typeand right amountof homeowners insurance coverage.

How to determine home insurance coverage. First take the square footage of your home and multiply it by local construction costs. Next use an online calculator to get a second estimate. Now you can make a more informed decision about how much home insurance coverage you need for your house.

Your insurance provider can help determine. To calculate a quick estimate call a local home construction company or real estate agent to find out the current rebuilding costs and multiply that number by the square footage of your home. Usually home insurance companies will use a combination of publicly available data and information you supply to determine your homes replacement cost for you.

You can find these costs on most construction companies websites or you can ask an independent insurance agent to figure out those costs for you. According to The Insurance Information Institute you should account for these things when calculating your Coverage A or Replacement Cost. The type of exterior wall.

Multiply the square footage of the home by the average cost per square foot to build in your area. Set a baseline with average costs in your area then adjust for the cost of your home full insurance and potential emergency coverage. To determine the total loss coverage for your property youll want to talk to a home insurance company or agent who probably represents various insurance companies who can determine the best.

Then you and your insurance company will come to an agreement on a fair cash value payout for the structure of your home with your dwelling coverage. Compare this amount with your mortgage and make sure that you are covered for the higher of the two. That should give you a pretty accurate estimation for what you should be paying to have your home.

Follow these easy steps. Looking for how to determine insurance coverage. At your service Young Alfred.

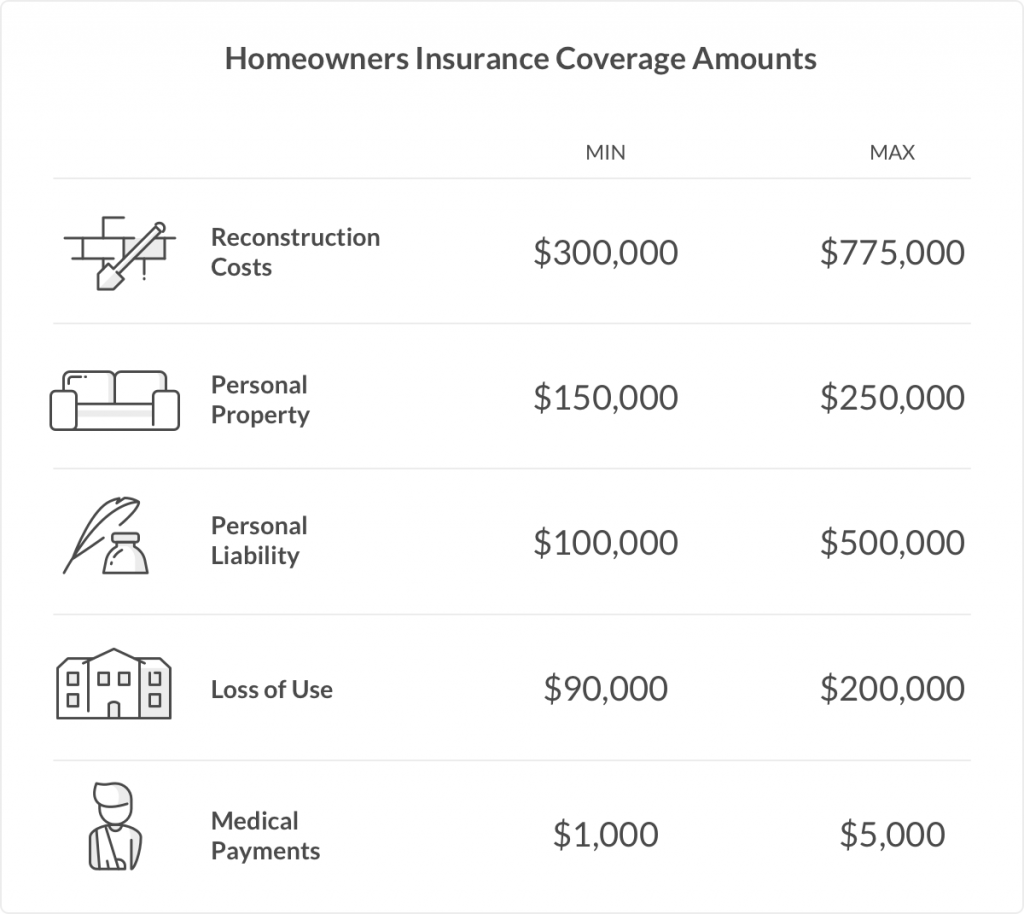

The coverage on your personal property is about 50 to 70 of what you insure your structure explains Carole Walker with Rocky Mountain Insurance Information Association. How to determine home insurance coverage how to determine home insurance coverage Information by State Find insuranceand how to determine home insurance coverage discounts in your state to get a policy that meets your unique needs and budget. Dont get caught underinsured when disaster strikes.

Your homes square footage including any additions youve added. According to the Insurance Information Institute most insurance companies will provide coverage for 50 to 70 of the amount of insurance you have on the structure of your home. Determine how much insurance you need for your possessions.

Check with your insurance agent to determine if you can purchase additional coverage beyond your loan amount. Your insurance coverage levels also impact your possessions as personal property coverage is a percentage of your insurance policy limits. It is important to understand that all your other homeowners coverages will be based on the amount of dwelling coverage you carry.

If the value of your personal items totaled 200000 you would have plenty of coverage. Determine Ho w Much Homeowners Insurance You Need. For example if your dwelling coverage limit is 250000 and your personal property coverage is limited to 50 of that amount you.

To learn if you have enough coverage. Factors that determine your insurance needs include the cost to rebuild your home the value of your personal items and your net worth. Insurers often inspect newly insured properties to confirm that the coverage you purchased matches the amount you actually need.

Figuring out how much your home insurance coverage should cost is fairly easy. To get the most accurate replacement cost value you want a reputable appraiser or contractor to give you an estimate. So if your dwelling coverage was 300000 you might get 210000 in personal property coverage at a rate of 70.

Go to how to determine insurance coverage page via official link below. However that standard amount may or may not be enough. When you have a home inventory its easy to determine how much personal property coverage you need.

Does my contents coverage include all of my possessions. Get direct access to how to determine insurance coverage through official links provided below. Then multiply the estimated amount by your homes square footage.

Most homeowners insurance policies provide coverage for your belongings at about 50 to 70 percent of the insurance on your dwelling. Simply enter your zip code and the square footage of your home click the calculate button and we will give you an estimate of your replacement cost. How to determine home insurance coverage Using the list below click on your state to learn more about how to determine home insurance.

Conduct a home inventory of your personal possessions. Rebuilding your home in the current economy using materials purchased just for your home is the amount your Coverage A should reflect. Find the official insurance at the bottom of the website.

Determine how much it would cost to rebuild your home at the current rates. You can find the average price-per-square-foot in your area by contacting a local builder or contractor. Estimate your home insurance coverage limits yourself.

The takeaway here is that your personal property may be underinsured if you dont have enough homeowners insurance on your structure. Our Home Insurance Calculator will quickly give you an estimate of how much dwelling coverage you should carry to fully protect your home. Some banks require you to have enough coverage in your policy to cover the mortgage so if this is less than it would cost to rebuild your home take the coverage amount the covers the rebuilding.

To determine how much coverage you need calculate the replacement cost for your home and any outbuildings or structures such as a garage pool. According to the Insurance Information Institute home insurance policies usually provide coverage for your items at 50-70 of your dwelling coverage.

Understanding Your Home Insurance Declarations Page Policygenius

Home Insurance Myths Busted Homeowners Insurance Home Insurance Homeowner

If You Live In A Neighborhood That Was Built 10 Years Ago A Knock At Your Door Might Not Be Opportunity Home Insurance Quotes Roof Damage Insurance Quotes

Elegir Su Propio Seguro De Salud Seguro De Salud 101 Blue Cross Blue Blue Cros In 2020 Health Insurance Companies Life Insurance Facts Health Insurance Plans

Homeowners Insurance Time For An Annual Check Up Homeowners Insurance Homeowner Best Homeowners Insurance

Insurance Myths Debunked Life Insurance Facts Life Insurance Policy Homeowners Insurance

Types Of Life Insurance Bankrate Life Insurance Insurance Marketing Life

Homeowners Insurance Is Made Up Of Coverages That May Help Pay To Repair Or Replace Your Home Homeowners Insurance Home Insurance Homeowners Insurance Coverage

Condo Insurance Guide Insurance Com Condo Insurance Homeowners Insurance Renters Insurance

End Of Year Insurance Checklist Florida Insurance Checklist Insurance

What Is Dwelling Coverage Insuropedia By Lemonade

Term Insurance Calculator Helps You To Calculate Online Term Insurance Premiu Life Insurance Calculator Health Insurance Infographic Life Insurance For Seniors

While Most Homeowners Purchase Ho 3 Coverage We Ll Explain The Options So You Know Which Plan Provides The Most Coverage Homeowners Guide Homeowner Coverage

Use Our Home Insurance Calculator To Learn What Upgrades You Should Make To Your Coverage After All Your Home Homeowners Insurance Homeowner Insurance Quotes

How To Reduce Homeowners Insurance Home Insurance Quotes Home Insurance Life Insurance Policy

Infographic The Difference Between Home Insurance And Home Warranties Your Home Should Have Both Home Warranty Home Insurance Home Insurance Quotes

Posting Komentar untuk "How To Determine Home Insurance Coverage"