Does Gap Insurance Cover Water Damage

It may not cover sewer or drain backups or flooding which would require additional coverages or policies. The average claim for water damage expenses is around 7000 though the actual amount your carrier will pay for is highly dependent on your particular issue and they certainly wont want to pay for more than you need.

Texas Gap Insurance Laws Companies Offering Coverage Valuepenguin

It is always a good idea to consider what types and levels of coverage you need before you are subject to something like water damage.

Does gap insurance cover water damage. Car payments in case of financial hardship job loss disability or death. Water damage can significantly reduce the. Comprehensive auto insurance is what covers damage to your car by.

Gradual damage is often considered preventable so insurance wont cover you in those cases. Gap insurance pays the difference between your cars value and what you owe on it if the vehicle is totaled in a crash or stolen. This product provides affordable coverage up to 175000 in excess of the water damage deductible limit on your condominium unit owner policy.

If youre a homeowner water is one of the biggest threats to your house and belongings. It will also cover any water damage that spread to other areas of the home. Like we mentioned earlier insurance does not cover roof leaks resulting from lack of maintenance.

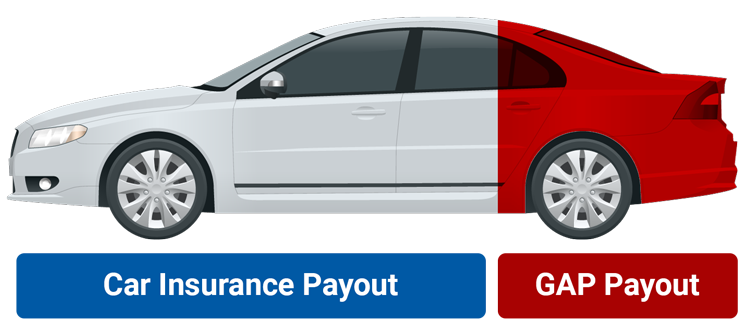

Comprehensive insurance -- If your vehicle sustains water or flood damage you can file a claim under your comprehensive insurance coverage. How does gap insurance work. Gap insurance covers the difference between what your insurer pays for your totaled vehicle and what you still owe.

Damage from sewage gradual leaks and neglect are also not covered. According to the Insurance Services Office ISO water damage claims are the second largest frequent insurance claim after wind and hail damage. No your home insurance never covers your vehicles.

The answer to the question does homeowners insurance cover water damage is multileveled just as the water damage might be. Claims due to water damage affect 1 in 50 homeowners each year. In general water damage caused by accident or mechanical failure of an appliance washing machine dishwasher water heater etc is going to be covered by standard policies.

There is a very specific definition of flood in the insurance industry and most homeowners insurance policies dont cover water damage due to flooding. Home insurance can be tricky when it comes to water damage such as leaks. Just 1 inch of water can cause up to 25000 in damage to a home or apartment The Cost of Flooding and Prevention Most homeowners pay less than 400 per year for flood coverage in low- to.

Water damage is one of the most common causes of home insurance claims. The value of your car or balance of a. You do need to properly maintain your home though so take appropriate measures to prevent pipes freezing if a slow leak causes damage that you shouldve known about and rectified it could invalidate.

This helps coverbridge the gap between the Strata building policy deductible AND the maximum deductible limit available under your personal condominium unit owners policy. Homeowners insurance will cover some types of water damage depending on the source. Homeowners insurance excludes coverage to your car and expect you to claim damages against your physical damage coverage if your vehicle sustains damage while at home.

GAP insurance is a type of auto insurance that technically stands for Guaranteed Asset Protection insurance but the name itself doesnt clarify what is actually being insured. Homeowners insurance also covers water damage if the proximate cause is a covered peril like wind-driven rain during a storm. We explain whats covered.

It works with your comprehensive insurance to cover theft. How much does insurance pay for water damage. Its reasonable to conclude that you might be able to make a claim to your gap coverage in cases of a blown engine or other total breakdown especially if a significant repair costs more than your cars value.

Its not just structural damage to consider if you have contents insurance the policy should cover the cost of replacing personal items ruined by water damage. Water damage from wind-driven rain or weight of snow vandalism and burst pipes are covered. Homeowners insurance does not cover water damage caused by floods sewer backup or general maintenance issues.

Repairs to your vehicle. Most homeowners insurance policies help cover water damage if the cause is sudden and accidental. Gap insurance does not cover.

However you might still be able to make a comprehensive claim it if your paint was damaged in a single event or weather-related incident. For example if you get into a wreck and the repairs to your vehicle would cost more than its value your car insurance covers your totaled vehicles actual depreciated valueessentially what a comparable make and model would sell for on the used-car market. Protection from flood damage requires a separate flood insurance policy.

That covers any type of damage to your car up to its actual cash value which is caused. You typically wont be able to claim paint damage when its the result of ongoing exposure to rain sand sun salt water or similar. In the insurance world flooding is defined as external ground water entering a building.

Homeowners insurance covers sudden water damage from something like a burst pipe. According to the Insurance Information Institute homeowners insurance may help pay for repairs if for instance your drywall is drenched after your water heater ruptures or an upstairs pipe bursts and water saturates the ceiling below. According to the Insurance Information Institute III homeowners policies like condo insurance may help cover water damage caused by burst pipes rain and ice dams.

GAP covers the difference between the amount you owe on an existing car loan or lease and the amount an insurer will pay in a total loss claim. Thats true even if your car is harmed in a flood fire tornado etc. Comprehensive will pay out up to the actual cash value of your car minus your deductible if your car is stolen.

So if you put off replacing cracked shingles or any other roof maintenance item. Its no wonder people have a lot of questions about it. This coverage would then pay the difference between that amount and what you owe on your loan.

Yes gap insurance covers your car if its stolen and not recovered.

Gap Insurance How Does It Work And Do I Need It Valuepenguin

Claims You May Not Know Are Covered

What Is Gap Insurance And What Does It Cover Credit Karma

Do You Need Gap Insurance For Your Car Forbes Advisor

Texas Gap Insurance Laws Companies Offering Coverage Valuepenguin

Totaled Car Guide Everything You Need To Know In 2021

Gap Insurance In Canada What Is Gap Insurance And Do You Need It

How Do You Know When To Total A Car From Flood Damage Carinsurance Com

Totallossgap Co Uk Take The Guesswork Out Of Gap Insurance

Car Totaled Or Stolen All Coverage Doesn T Pay Equally State Farm

What Is Gap Insurance In Texas

Does Gap Insurance Cover Transmission Repairs Protect My Car

How Does Gap Insurance Work After A Car Is Totaled

Does Gap Insurance Cover Transmission Repairs Protect My Car

Understanding Gap Coverage Ally

Totaled Your Car No Insurance Here S How To Get Paid Cash Fast

Do You Think You Know All About Insurance Fun Facts Know The Truth Facts

Posting Komentar untuk "Does Gap Insurance Cover Water Damage"