Reserve Coverage Ratio Insurance

Incurred But Not Reported IBNR The loss reserve value established in recognition of the total liability for future payments on losses which have occurred but have not yet been reported to the insurance company. Walter In 2014 US.

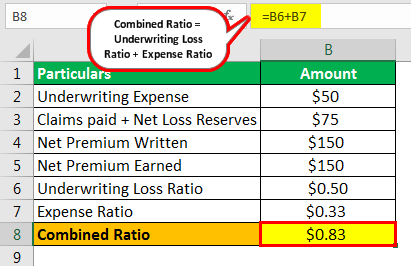

Combined Ratio Benefits And Limitations Of Combined Ratio

To use this equation follow these steps.

Reserve coverage ratio insurance. To facilitate use of these Federal Reserve facilities and to ensure that the effects of their use are consistent and predictable under the Liquidity Coverage Ratio LCR rule the Office of the Comptroller of the Currency the Board and the Federal Deposit Insurance Corporation together the agencies are adopting this interim. An ICR below 15 may signal default risk and the refusal of lenders to lend more money to the company. Whereas a liability insurance company might only need to have a Quick Liquidity Ratio of 20 or more.

EB16-01 - Federal Reserve Bank of Richmond Understanding the New Liquidity Coverage Ratio Requirements By Mark House Tim Sablik and John R. The Federal Reserve the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency collectively the agencies are jointly issuing the attached Frequently Asked Questions FAQs regarding implementation of the LCR and modified LCR rules. Errors and omissions insurance is a type of professional liability insurance that protects against claims of inadequate work or negligent ac.

The ratio applied to loss costs at a given per occurrence limit. This isnt as complex as it might sound. The standard LCR banks nearly doubled their liquid assets between January 2010 and January 2015 to 20 percent which is more than 5 times the corresponding ratio in 2006.

An Asian Monetary Fund and to analyzing one leg of optimal reserve-holding decision. Its probably a good idea to define what an actuarial reserve actually is. Companies measure their rainy day fund by using the loan loss coverage ratio.

As a general benchmark an interest coverage ratio of 15 is considered the minimum acceptable ratio. Modified LCR banks stepped up their accumulation of liquid assets as well and achieved 12 percent HQLA-to-asset ratio. The LCR should be a key component of the supervisory approach to liquidity risk.

It examines an insurers leverage underwriting activities and financial performance. The liquidity coverage ratio is the requirement whereby banks must hold an amount of high-quality liquid assets thats enough to fund cash outflows for. On September 3 2014 the Office of the Comptroller of the Currency OCC the Board of Governors of the Federal Reserve System and the Federal Deposit Insurance Corporation issued a final rule that implements a quantitative liquidity requirement consistent with the liquidity coverage ratio LCR standard established by the Basel Committee on Banking Supervision BCBS.

The Office of the Comptroller of the Currency OCC the Board of Governors of the Federal Reserve System Board and the Federal Deposit Insurance Corporation FDIC collectively the agencies adopted a final Liquidity Coverage Ratio rule 1 LCR rule in September 2014 that implements a quantitative liquidity requirement consistent with the standard established by the Basel Committee. A companys loan loss coverage ratio is calculated by. Financial regulators introduced new liquidity coverage ratio requirements for qualified banking institutions.

The Federal Deposit Insurance Corps first-quarter report on bank earnings said the ratio of loan-loss reserves to noncurrent loans rose for the sixth straight quarter but some doubt the reserve coverage ratio is rebounding fast enough. A company reports an operating income of 500000. Administrative Services Only ASO Definition.

This quantitative framework is applied to calculating the cost of a regional insurance arrangement eg. The insurance value of reserves is quantifled as the market price of an equivalent option that provides the same insurance coverage as the reserves. The Liquidity Coverage Ratio.

The Committee has developed the LCR to promote the short-term resilience of the liquidity risk profile of banks by ensuring that they have sufficient HQLA to survive a significant stress scenario lasting 30 calendar days. The reserve ratio set by the central bank is the percentage of a commercial banks deposits that it must keep in cash as a reserve in case of mass customer withdrawals. An actuarial reserve is used to account for the amount of money that an insurance company will be liable to pay in the event of a claim based on an estimate of the present value of all future income that is derived from a contingent event.

Insurers with mixed product portfolios are less easy to evaluate. Its considered good practice for an investor to compare the insurer to other insurers with similar portfolios to see if the Quick Liquidity Ratio is appropriate for the risks insured. Interest coverage ratio Operating income Interest expense.

Bests Capital Adequacy Relativity BCAR is a rating of an insurance companys balance sheet strength. This regulation based on. Proved Reserves Coverage Ratio means the ratio of the i PV10 of the Proved Reserves of the Issuers and Guarantors Oil and Gas Properties as of the latest Reserve Report to ii the Consolidated Senior Secured Debt as of the date such ratio is calculated.

Expected future development on. Your rainy day fund is the money you set aside in case you lose your job and stop making money. Especially as it remains the primary reason countries accumulate reserves for insurance purposes the metric is based on balance of payments drains experienced during EMP episodes ie a measure of sufficient reserves during periods of pressure and ahead of a full-blown crisis.

1 In the attached FAQs the agencies provide interpretations based on the facts and circumstances described in each question.

:max_bytes(150000):strip_icc()/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Corporate Insurance Policies Protect Companies From Loss

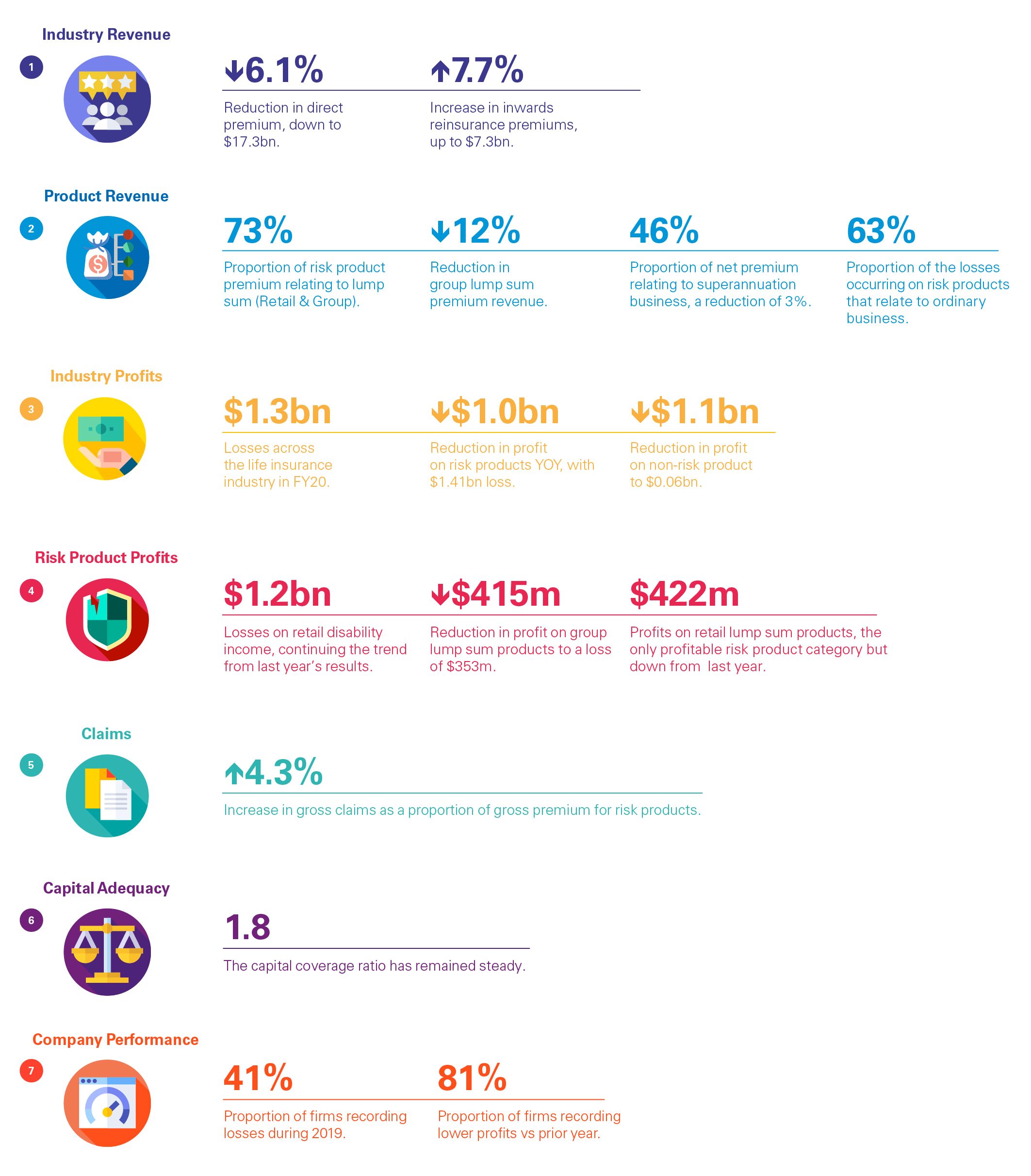

Life Insurance Insights 2020 Kpmg Australia

North America Industrial Insulation Market Worth 2 55 Billion By 2025 Grand View Research Inc Energy Conservation Environmental Degradation Insulation

What Is Persistency Ratio Importance Of Persistency In Insurance Sectoraegon Life Blog Read All About Insurance Investing

How To Reduce Insurance Claims Leakage And The Loss Ratio Via Standardization Business Intelligence And Robotic Process Automation Rpa The Lab Consulting

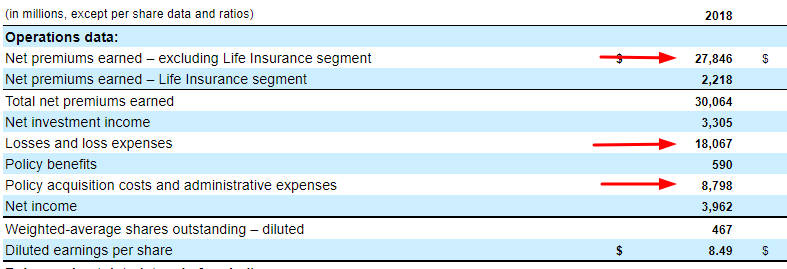

Combined Ratio In Insurance Definition Formula Calculation

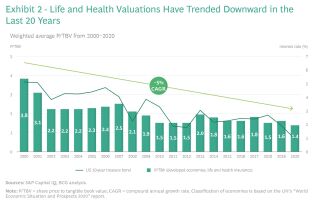

The 2021 Insurance Value Creators Report Reinvention Paves The Way To A Bright Future Bcg

Combined Ratio In Insurance Definition Formula Calculation

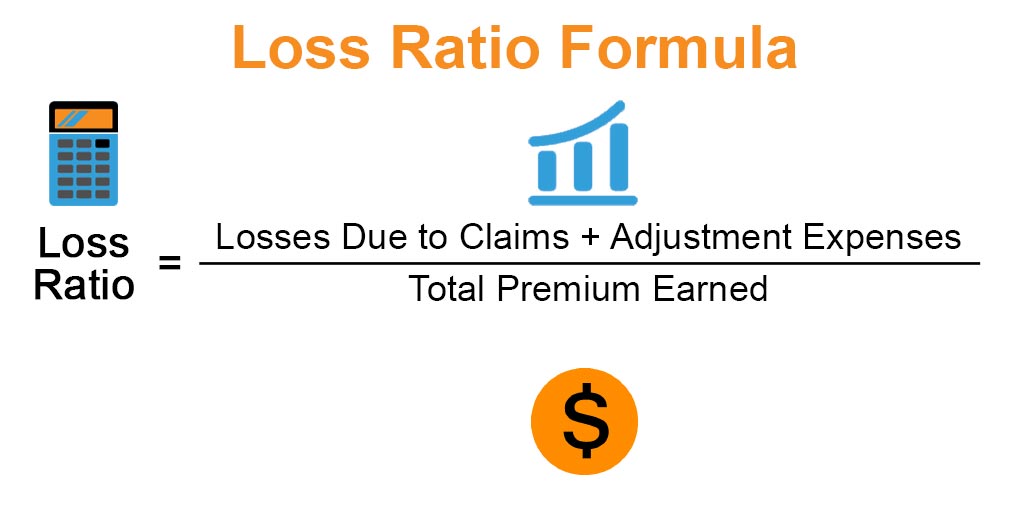

Loss Ratio Formula Calculator Example With Excel Template

:max_bytes(150000):strip_icc()/GettyImages-1134608647-d06eff10dc3746119683550068860dae.jpg)

Corporate Insurance Policies Protect Companies From Loss

The 2021 Insurance Value Creators Report Reinvention Paves The Way To A Bright Future Bcg

How The Combined Ratio Reveals Profitable Insurance Companies To Investors

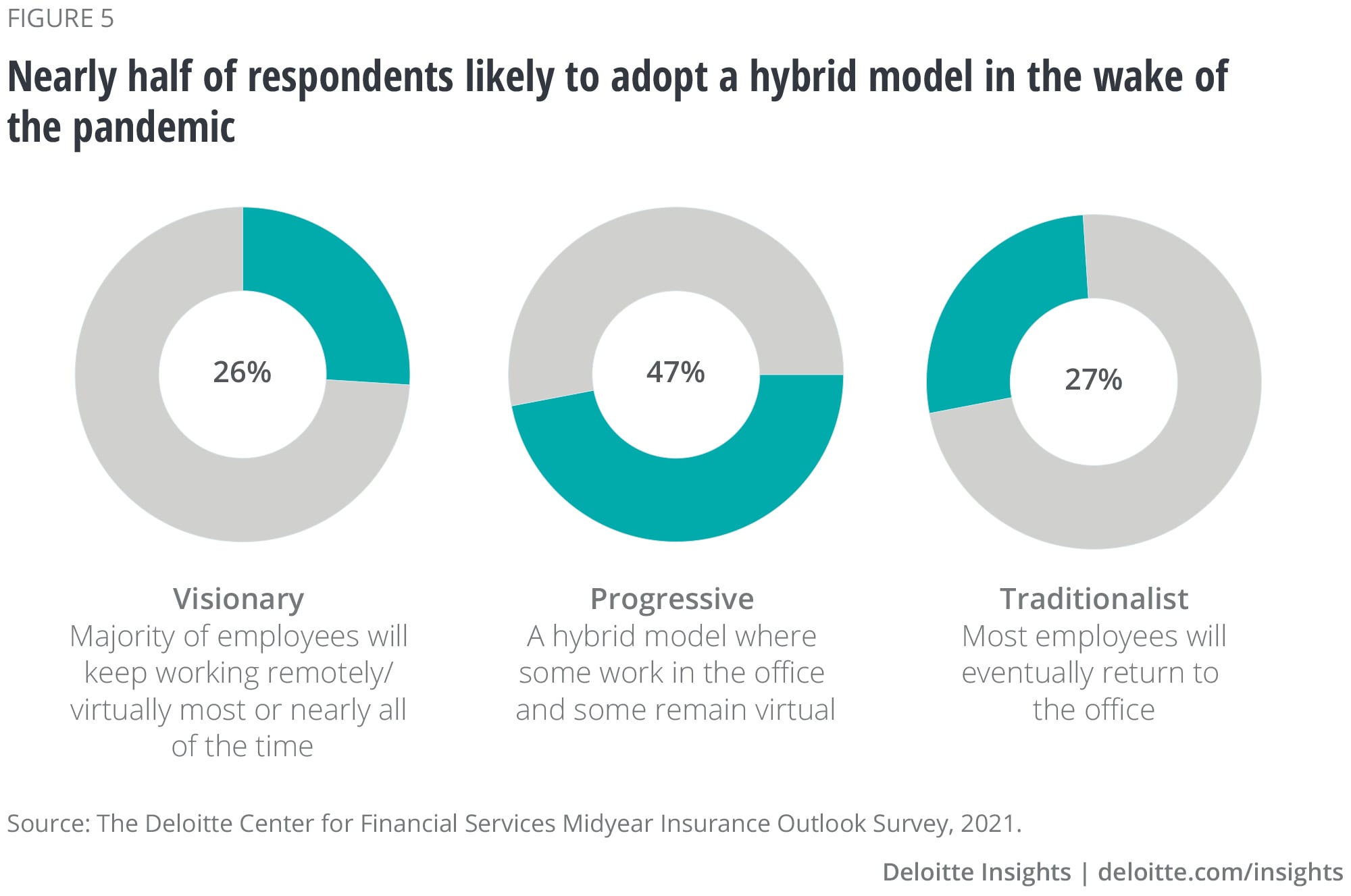

Pandemic Impact On The Insurance Industry Deloitte Insights

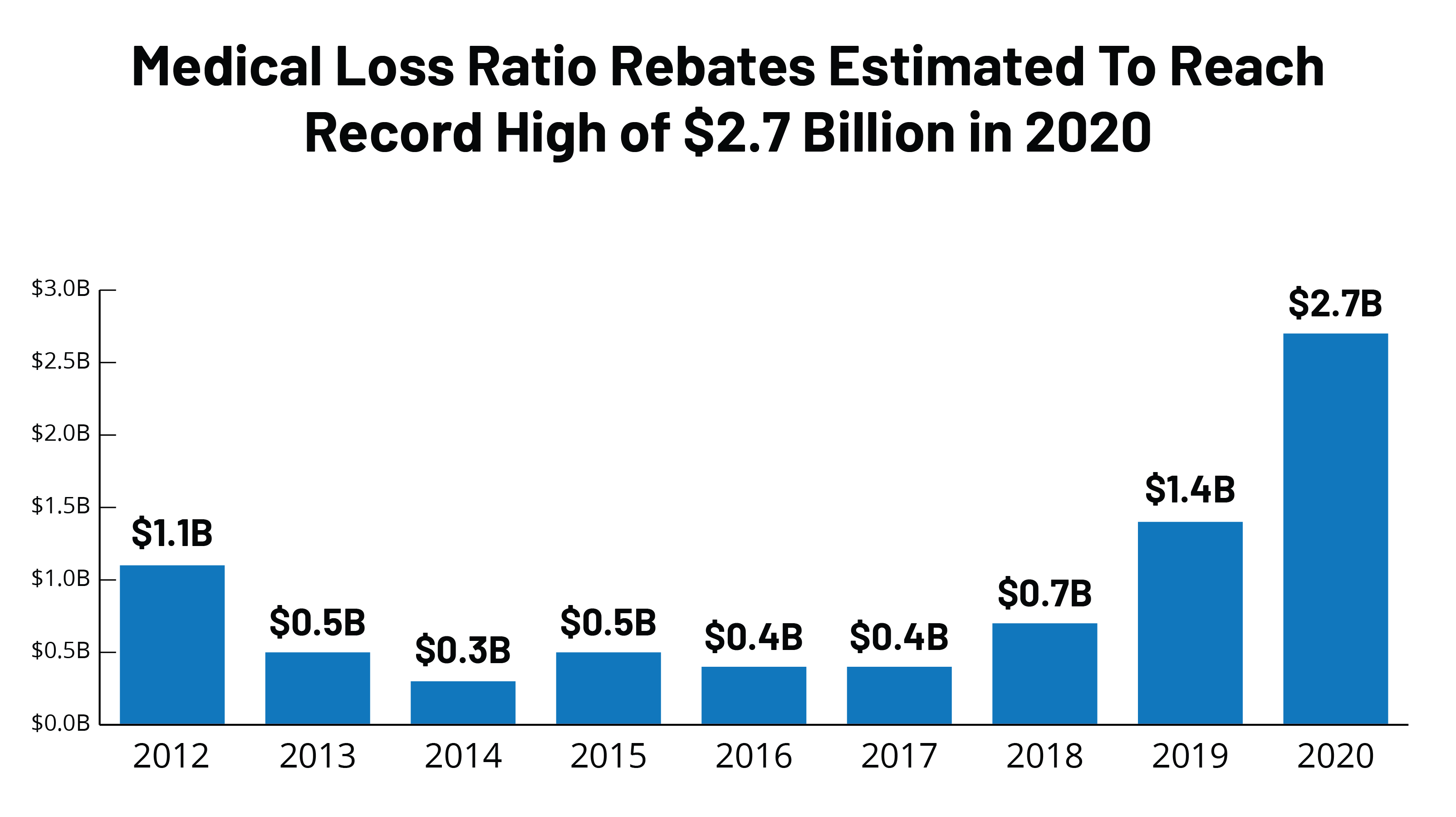

Data Note 2020 Medical Loss Ratio Rebates Kff

How To Reduce Insurance Claims Leakage And The Loss Ratio Via Standardization Business Intelligence And Robotic Process Automation Rpa The Lab Consulting

What Is Persistency Ratio Importance Of Persistency In Insurance Sectoraegon Life Blog Read All About Insurance Investing

Posting Komentar untuk "Reserve Coverage Ratio Insurance"